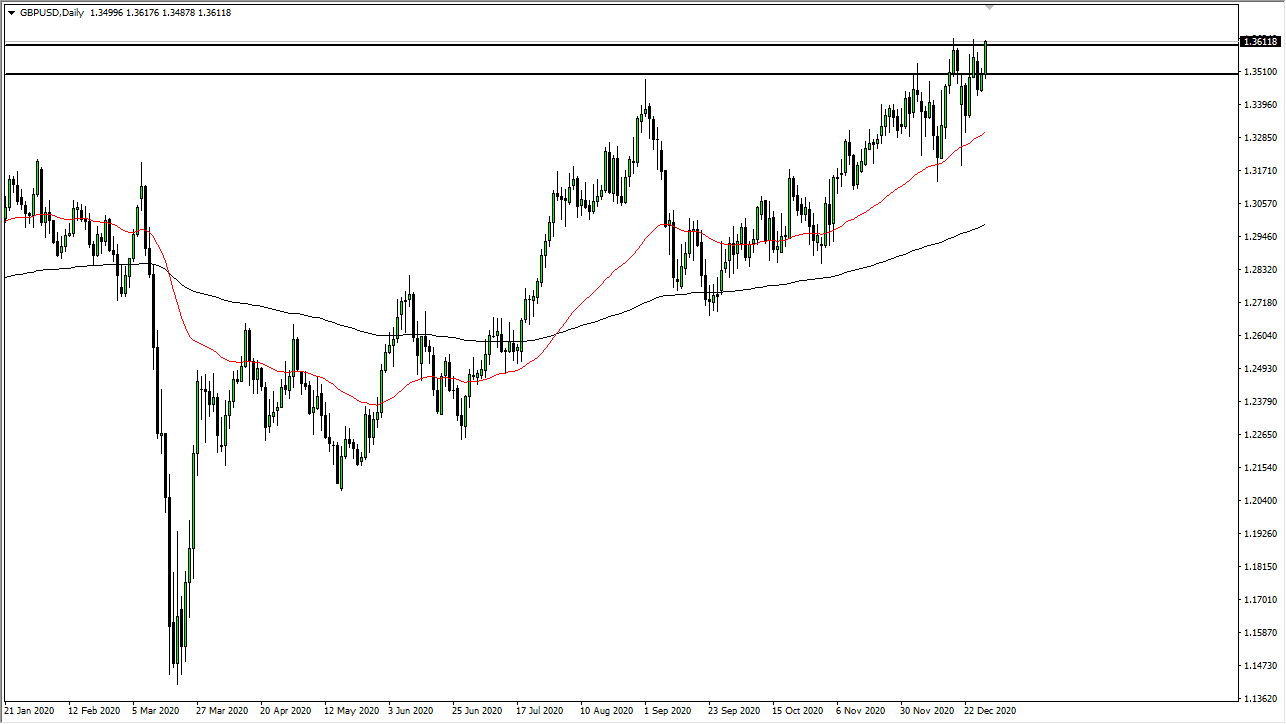

The British pound rallied during the trading session on Wednesday to reach above the 1.36 level yet again. This is an area that has now formed a “triple top”, but one thing that should be paid attention to is the fact that we are closing towards the top of the range, which typically means you get a bit of follow-through. I believe the British pound will continue to go looking towards the 1.3750 level, an area that has been resistance previously. This is a market that has been chipping away at short selling, and now that we have the Brexit deal signed, it clears up a lot of the gloom over the pound.

The 50-day EMA underneath has offered support multiple times, so even if we do get a major selloff, that is about as far as we go. In that area, we have seen more than enough buyers jump in to pick the market out, so there is no reason to think that this will change. Yes, the United Kingdom is locking itself down, which could cause major issues, but it seems as if markets are already trying to look past the overall coronavirus issue. The idea is that eventually we will get the vaccinations to everyone and economies will open up. In such a case, there should be an explosive move to the upside for a lot of risk assets.

On the other side of the Atlantic Ocean, the Americans are cranking out stimulus, which will work against the value of the US dollar. The British pound is historically cheap in this area, so it does suggest that certain value hunters and longer-term traders will be willing to get involved. Eventually, we will go much higher, but there is probably a lot of work to be done in the meantime. This is a market that will be very choppy upon the latest headline, but clearly the direction is still probably higher from here. Keep in mind that the next several sessions will be very thin in general, as traders are worried more about holidays than anything else. Buying the dips is probably the best way to go, assuming that you even get the opportunity based upon what I am seeing now.