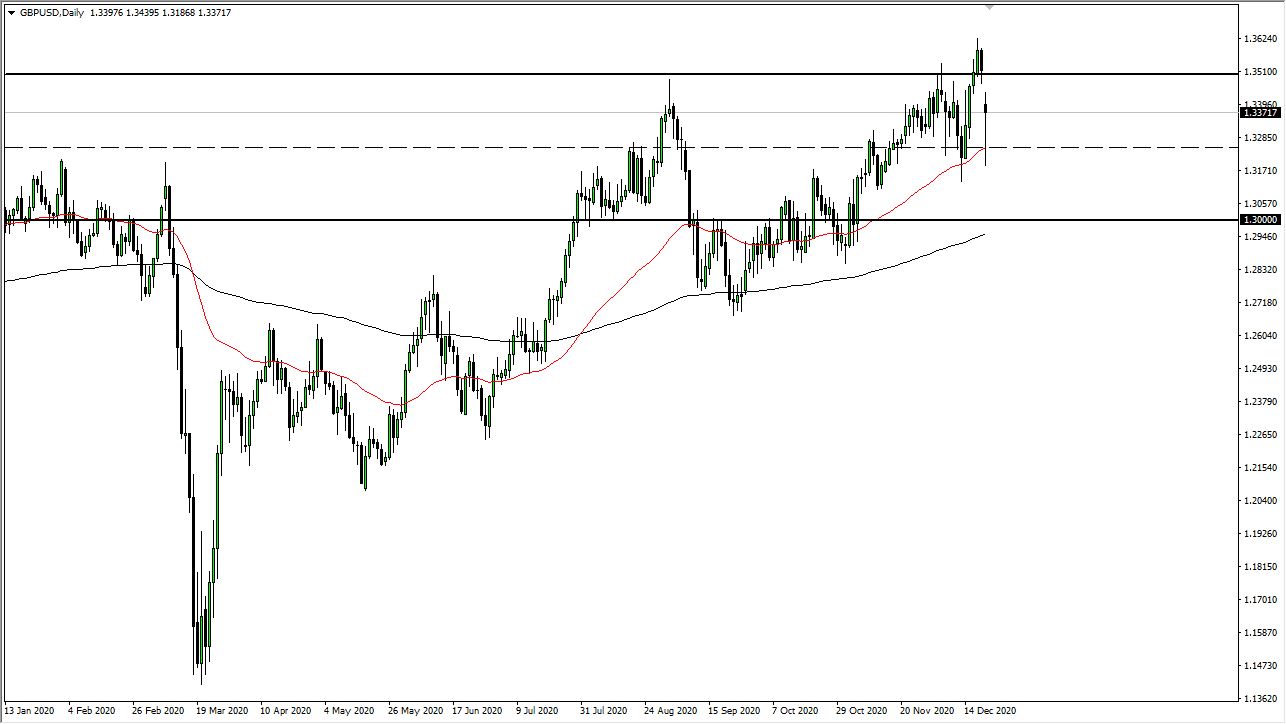

The British pound gapped lower on Monday after there were major concerns regarding the coronavirus mutations. The market is likely oriented towards things getting out of control again, and with the UK economy shutting down, it follows that the British pound would get sold off. However, by the end of the day, you can see that we have recovered quite nicely, using the 50-day EMA as a springboard from the 1.3250 level which is a significant support level.

There is a gap above, but we have not quite yet filled it. The 1.35 level above was skipped past at the open, and it is very likely that the area could offer a significant amount of resistance. The 1.35 level is a large, round, psychologically significant figure that people will be watching. The shape of the candlestick is a hammer, showing signs of buying pressure underneath. The 1.36 level above is the high, and if we can break above the 1.35 level, I would anticipate that we will go looking towards that area. It is a bit difficult to get overly excited about going long this time of year though, because the holiday trading is very thin. In fact, that was probably a major driver of what happened during the day.

It is not that the British pound should not have sold off, it is just that it was completely overdone due to the lack of volume. One thing is for sure: we made a massive turnaround throughout the day, so the British pound is still focusing more on Brexit than anything else. All it will take is a couple of good headlines coming out involving Brexit, and we could see the British pound rally yet again. Do not get me wrong; I am not necessarily bullish on the British economy right now, it is just that price dictates what happens next, and it is obvious that price continues to find reasons to go higher. If we broke down below the lows of the trading session on Monday, then we could go lower, perhaps reaching towards the 1.30 level. The way this is going, one would think that it is only a matter of time before we find yet another reason to go higher.