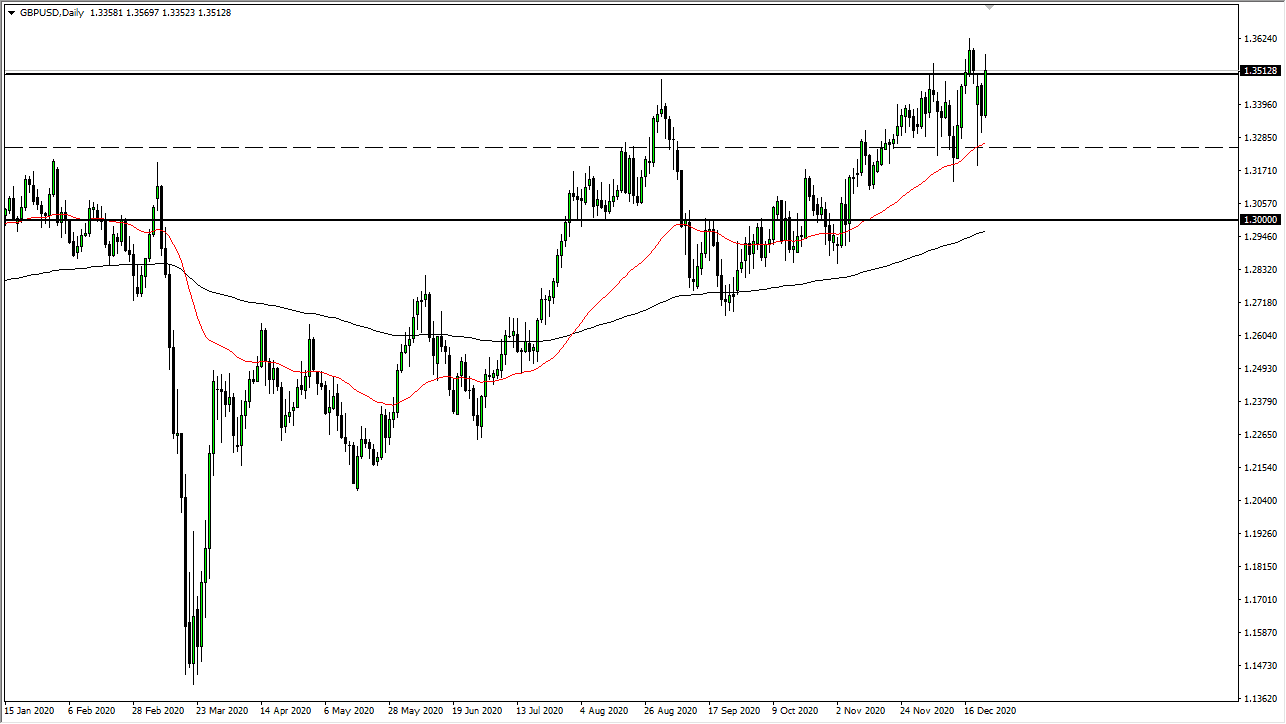

The British pound was very bullish during the trading session on Wednesday as Brexit negotiators are getting close to the end. It should be noted that a couple of different EU officials have suggested that a deal is “all but done and could be signed within the next 24 hours.” The British pound rallied as a result, filling a gap near the 1.35 handle. However, later in the day, it pulled back just a bit as traders are waiting to see whether or not there is any type of confirmation from British negotiators.

If we do get some type of pullback, and it is very possible due to the fact that the markets are focusing on holidays as well, there are plenty of areas underneath that could support this market. Unless something falls apart in the negotiations and sends things into a very negative attitude, this market has a very limited downside. Nonetheless, the first thing that I would pay attention to is the 50-day EMA which is currently sitting at the 1.3250 level. That is an area that should be supported, assuming that we get a jolt to the downside. However, this would not be true if they suddenly announced that there was going to be no deal at all. However unlikely that is, if that were to happen, this pair would probably come undone.

The size of the candlestick is rather impressive, and it should be noted that the British pound gained over 1% during the trading session. That is a relatively big move, but as you have seen over the last several weeks, every time this market pulled back buyers have gotten back into the market to lift it again. This has been a good trading environment for some time, and one has to wonder how much more momentum to the upside we have once the deal is done. I suspect we will probably go a couple of handles higher before we start to pull back and show signs of exhaustion. After the deal is done, it will come down to the British economy itself, which looks very threatened by the lockdown and extension of the mutated coronavirus. We could see a short-term rally followed by more bearish pressure if things do not pick up.