With the holidays approaching, investors prefer to make profits, especially after recent record gains. Therefore, the EUR/USD moved with a steady decline around the 1.2180 level at the beginning of today's trading.This came after the pair achieved gains last week that reached the 1.2272 resistance, its highest level in nearly three years. Markets may react this week to the late progress among lawmakers in Washington who are expected to vote on a $900 billion subsidy program for households and companies, which could support risky assets such as stocks and the euro.

However, the "stimulus package", which is barely a third of the size of the one seen in March, is not sufficient to prevent the euro from correcting downward. Recently, some countries have already announced additional restrictions for the first half of January (e.g., Germany's lockdown from December 27 - January 10), but if case numbers are still high in early January, lockdowns will last much longer.

Leading the race to draw attention to, and put potential pressure on, the euro is the new coronavirus strain in the United Kingdom, which was responsible for Prime Minister Boris Johnson's decision on Saturday to return large sectors of the economy to a "closed" position, at least until the end of the year.

The new strain of coronavirus is more contagious than others, and due to some of its mutations, there is uncertainty about whether it can be prevented at all by using the various coronavirus vaccines that are now making their way to the market. We have already seen that the Netherlands is banning flights from the United Kingdom after the country detected the virus in a traveler from Britain, but it will likely be a burden on the euro and financial markets as well if it forces investors to reconsider their assumptions about the global economic recovery in 2021. David Sneddon, Head of Technical Analysis at Credit Suisse says: “EUR/USD saw a decisive breakout above 1.2155 and we maintain our basic bullish outlook for the bullish resumption to 1.2355. The support moves up to the 1.2213 level at the beginning, then 1.2191, and below that, it could mitigate the immediate bullish tendency."

Germany, the Netherlands, Austria, Denmark and Italy are among the large European economies that have all imposed a new "lockdown" for the coming weeks in response to increases in infection numbers, although anything that raises the risk of prolonging the disease may also come as a blow to sentiments and the desire to take risks.

US retail sales for the month of November fell less than expected, with a change of -0.5% against expectations of 0.2%. General retail sales for the period also came in below expectations (MoM) of -0.3% with a change of -1.1%. Excluding auto, retail sales missed expectations (MoM) of 0.1% with change of -0.9% (MoM). Then the US jobless claims for the week ending December 11th came below expectations of 800K, with a record 885K. On the other hand, ongoing claims for the previous week exceeded 5.598 million, recording 5.508 million. Building permits and housing starts also exceeded expectations.

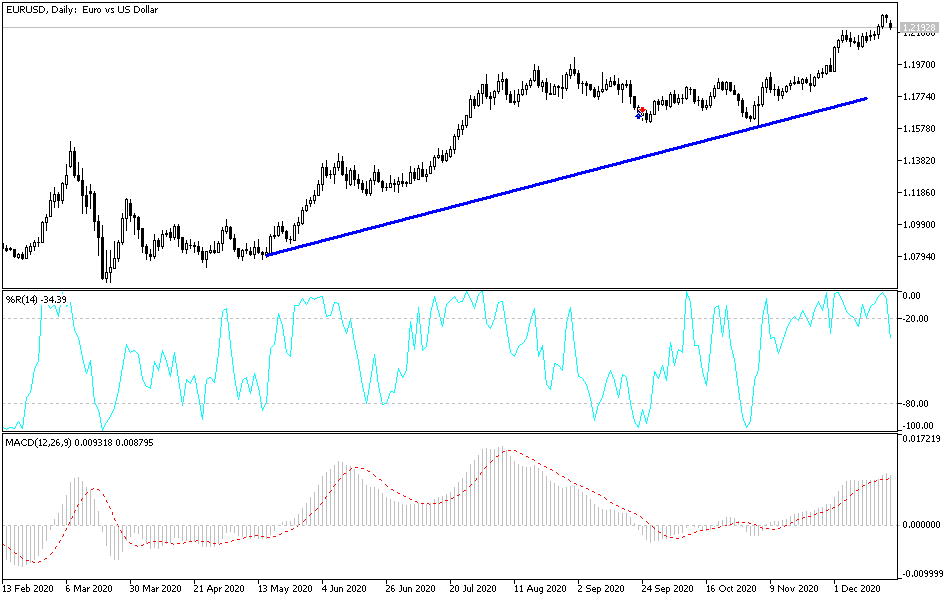

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD currency pair is trading within the formation of an ascending channel. This indicates a significant short-term bullish bias in market sentiment. Accordingly, bulls will look to extend the current gains towards 1.2270 or higher at 1.2303. On another hand, bears will be looking to take a hold for short-term pullback gains around 1.2200 or below at 1.2164.

In the long term, and based on the performance on the daily chart, it appears that the EUR/USD is trading in a steep upward curve. This stems from the slightly descending wedge formation. The pair is now in the overbought territory of the 14-day RSI. Therefore, bulls will look to extend this rally towards 1.2394 or higher at 1.2563. On the other hand, bears will target long-term pullbacks around 1.2023 or below at 1.1810.