Risk currencies were subject to declining price gaps at the beginning of trading this week, amid fears of new strains of a COVID-19 virus. This increased investor’s concerns about the failure of new vaccines and harsher restrictions on European economic activities ahead of the end of year holidays. The effect on the EUR/USD was to move towards the 1.2129 support, but the pair quickly rebounded to the upside with gains reaching the 1.2248 resistance at the time of this writing, immediately after the Europeans announced the approval of coronavirus vaccines. This gave investors confidence again, raising hopes that countries will begin giving their citizens their first vaccinations shortly after Christmas.

The European Union’s Executive Committee gave the green light just hours after the European Medicines Agency announced that the vaccine met safety and quality standards. Brussels was expected to take two or three days to approve the market licensing move. In this regard, European Commission President Ursula von der Leyen said: "As we promised, this vaccine will be available to all European Union countries at the same time, and with the same conditions. That's a very good way to end this difficult year, and finally to start turning the page on COVID-19."

She said that the vaccine has been delivered to start next Saturday, with vaccinations starting across the European Union between December 27 and 29.

The Amsterdam-based EMA is responsible for approving all new drugs and vaccines across 27 member states of the European Union, Iceland, Liechtenstein and Norway. It is roughly equivalent to the U.S. Food and Drug Administration. The vaccine itself was licensed in Britain and the United States of America weeks ago, prompting European Union governments to pressure the EMA agency to speed up the approval process as the virus cases spiked again across the European continent. The EMA had originally set December 29 as the date for evaluating the vaccine, but it accelerated the meeting to yesterday after calls from the German government and others for the agency to move more quickly.

On the US side, plans to stimulate the US economy in the face of the pandemic were approved after a series of US economic releases that showed how weak the economic performance was without those plans. The US labor market was the most prominent loser.

Technical analysis of the pair:

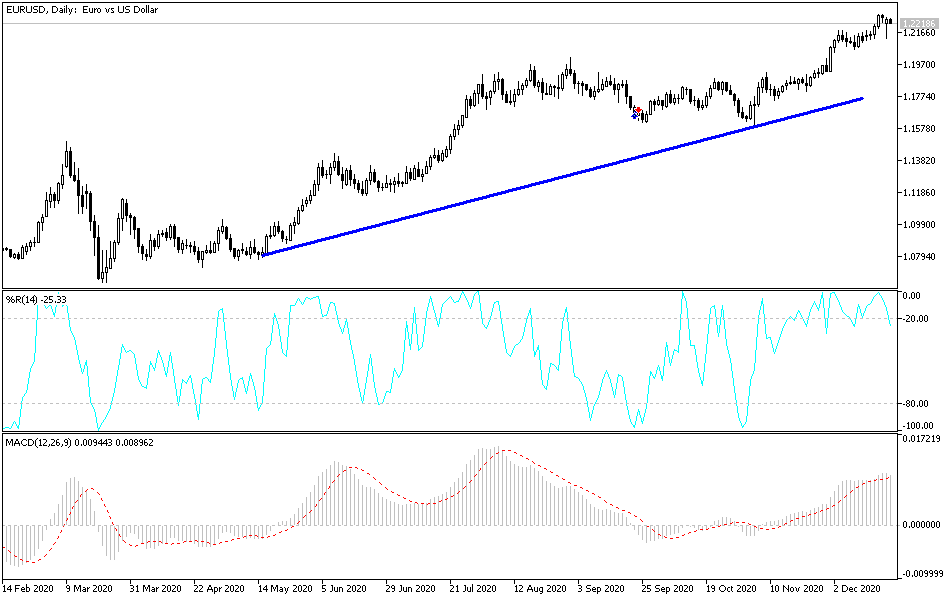

The return of the EUR/USD price to move quickly above the 1.2200 resistance increased the bulls' control of the trend and thus the preparation for stronger gains in the upward path that the currency pair has enjoyed since the beginning of November. According to the performance on the daily chart, breaking the 1.2275 resistance pushes the technical indicators to the overbought areas, which explains the technical movement down to strength with a change in market sentiment. On the downside, there will be no new control of the bears over the general direction of the pair without breaching the 1.2000 psychological support - the psychological top fromba few weeks ago. The Forex market will watch the reaction from the increasing numbers of coronavirus cases and, at the same time, the restrictions to contain it and the start of vaccinations.

Today's economic calendar:

The GFK Index reading for German consumer climate will be announced first. From the United States, the most important releases will be the GDP growth rate, the US Consumer Confidence Index and existing US home sales.