For three trading sessions in a row, the EUR/USD pair has been moving in a downward correction range. Investors are preparing for the holidays by selling the pair's recent gains, which reached its highest levels since April of 2018 when it tested the 1.2272 resistance during last week’s trading. The beginning of profit-taking pushed the currency pair towards the 1.2130 support before settling around 1.2170 as of this writing and before the announcement of important economic data for this week. With the beginning of next year's transactions, financial markets will await the reaction to the US and European economic stimulus plans to counter the effects of the COVID-19 pandemic. Despite this, recent restrictions to contain the new strains of the pandemic, coinciding with the launch of vaccines, negatively affected investors’ and even individuals’ sentiment. Survey results from the GFK market research group showed that German consumer confidence is expected to decline in January due to the tough lockdown measures introduced to face the second wave of COVID-19 infections. Accordingly, the forward-looking Consumer Confidence Index decreased to -7.3 in January from -6.8 in December. The result was expected to decrease to -8.8.

Commenting on the results, Rolf Borkel, consumer expert at GfK, said: "At the moment, the savings index is mainly responsible for the third consecutive decline in the consumer climate. With severe closures and most stores closing, the consumer climate has to cope with another setback."

Among the subcomponents of the CPI, the economic outlook and the tendency to buy rose from November, while income expectations deteriorated in December. After two consecutive declines, the economic outlook rose 4.6 points, to 4.4 in December. Contrary to the economic outlook, income expectations declined in December. The index fell to 3.6 points from 4.6 a month ago. Meanwhile, the tendency to buy index rose 6.1 points to 36.6 in December.

Revised data released by the Commerce Department showed that the US economy recovered slightly more than expected in the third quarter of 2020. The official report showed that the rise in GDP in the third quarter was revised upwards to 33.4 percent from 33.1 percent previously. Economists had expected the jump in GDP to remain steady.

The Commerce Department also said that the unexpectedly upward revision primarily reflects larger increases in consumer spending and non-residential fixed investment. The big increase in GDP in the third quarter followed a record contraction in the second quarter, when the GDP fell by -31.4 percent.

Commenting on the US growth numbers, Gregory Daco, chief US economist at Oxford Economics said: "The main contributors to the gains were manufacturing, health care, accommodation, food services, retail and wholesale trade." However, he added: "The recovery is still far from complete, with production remaining below pre-COVID-19 levels across many industry groups."

On the inflation front, the report stated that core consumer prices, which exclude food and energy prices, rose 1.4 percent year-on-year in the third quarter, reflecting an acceleration from the 1.0 percent increase in the second quarter. The annual rate of core consumer price growth is still well below the Fed's target of 2.0 percent, which the US central bank said it wanted to moderately exceed for some time before considering raising interest rates.

"As we look to 2021, expectations will be one of contradictions," the Oxford Economics analyst added. "The general economy will start very cautiously, and it will be vulnerable to hiccups during the micro-vaccine deployment phase. But with the emergence of a combination of increased government transfers and large-scale vaccinations, we should expect gradual steady activity leading to a small summer boom. We expect real GDP growth of about 4.5% on average in 2021 after contracting by 3.4% in 2020."

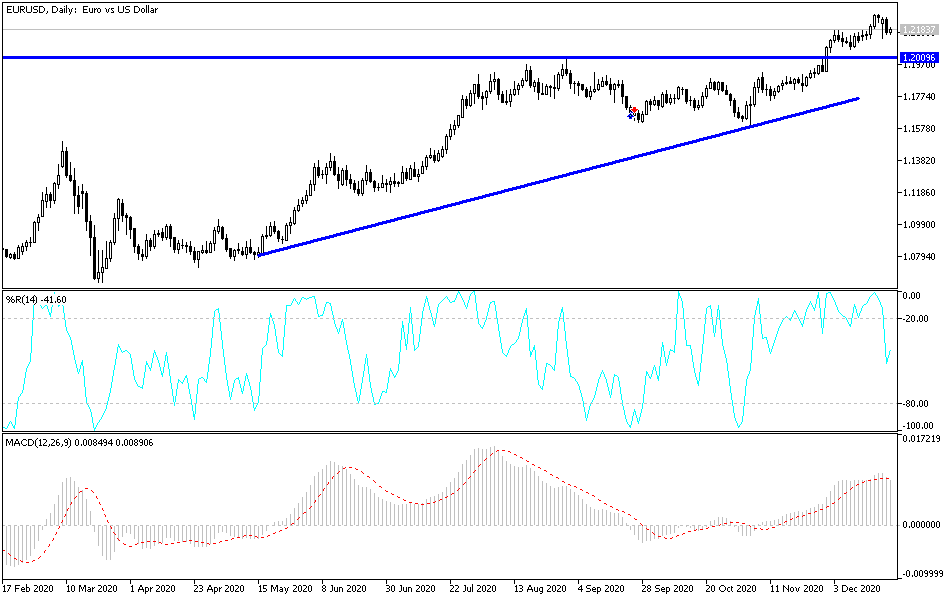

Technical analysis of the pair:

Despite the recent EUR/USD downward movements, the general trend is still upward, as shown on the daily chart. There will be no real reversal of the current general trend to the downside without breaking the psychological support level at 1.2000. On the other hand, stability above the 1.2200 resistance is still a catalyst for bulls to dominate the performance. With the annual holidays nearing, I see selling at every upward level is best for dealing with the currency pair.

Today's economic calendar:

The focus will be on a torrent of US economic data, the most prominent of which are the reading of the Personal Consumption Expenditure Price Index - the Fed’s preferred measure of US inflation - as well as the average income and spending of American citizens, durable goods orders, unemployed claims, and new home sales.