With risk appetite increasing due to announcements regarding coronavirus vaccines, the EUR/USD pair is correcting towards its highest gains and has so far reached the 1.2310 resistance, its highest since April of 2018. Consequently, in the last trading hours of 2020, the pair is on its way to close up after a sharp collapse last March to the 1.0637 support at the height of the COVID-19 outbreak.

Commenting on the future of Europe during the era of the epidemic, Stephen Gary Steen, chief European economist at Goldman Sachs, said: “Despite the lull in the pandemic, the risk of political fragmentation remains, especially in the countries of the South. In Spain, this relates to regional fragmentation, which is likely to rise to the surface once the state of emergency ends. In Italy and the northern countries, it is mainly related to the popularity of the skeptical parties in the European Union, which remain a powerful political force...There are tensions around the upcoming discussion in Europe about monitoring the recovery plan funds and reactivating the European Union's financial monitoring framework." A very relaxed (Draconian) approach could lead to tensions in the net contributing (recipient) countries, risking another fight - the European populist wave. These risks could re-emerge with the upcoming national elections in 2021 (Germany and the Netherlands) and 2022 (France and possibly Italy after the election of the president).

The European Commission suspended the rules in 2020 to prevent them from impeding the response to the pandemic, although sooner or later it is imperative that a very political decision be taken on whether and to what extent they will return. Neglecting its re-imposition while the European Central Bank continues to “adapt its asset purchases to the pace of government debt issuance,” would be an exciting proposition, if not unimaginable, for many in Germany.

Accordingly, the year 2021 and beyond will reveal the extent of suspicion surrounding the European Union in Germany, not to mention a handful of other European countries. It may turn out that the European Council's reform of the budget process for 2020 raises ugly political scenes. After all, this reform gave every national leader a veto over other countries' individual budgets, in addition to the current veto over the entire EU budget.

Meanwhile, there is a cautionary tale in the Brexit saga, which illustrates among other things how supposedly marginal political actors do not necessarily need to hold the highest office or even any office at all in order to shape the political landscape for years, if not decades, to come.

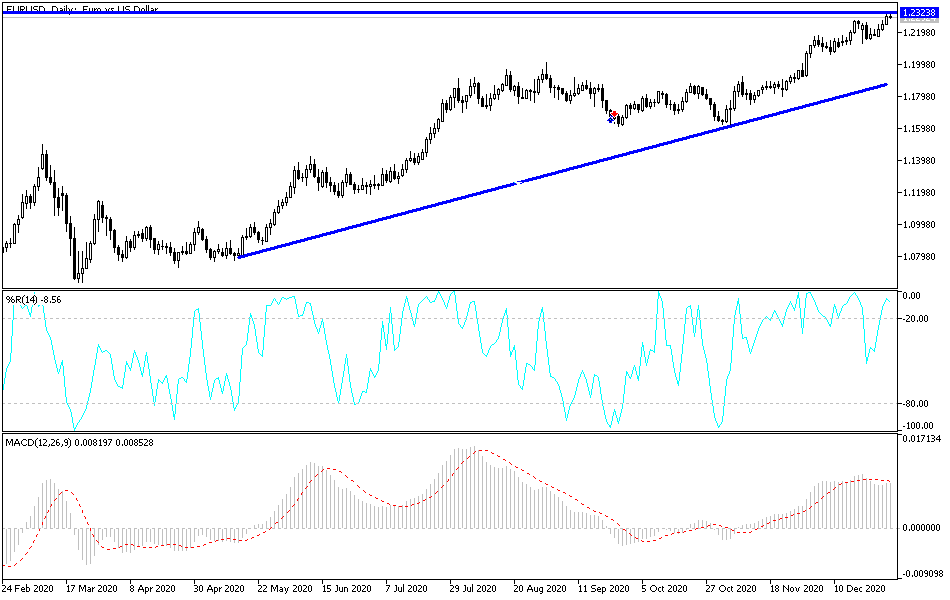

Technical analysis of the pair:

The bulls' control is still stronger, and breaking the 1.2300 resistance was possible with the continued US dollar weakness. Continued risk appetite means more opportunities for the pair to test higher peaks, with the closest ones currently at 1.2345, 1.2440 and 1.2555, respectively. On the downside, and as I mentioned before, the bears will not dominate the performance without currently testing the 1.2000 psychological support. It should be noted that the recent gains of the pair pushed technical indicators into strong overbought areas. Expect to see profit-taking sales at any time.

Today, the economic calendar has no important data announcements from Europe. From the United States of America, the weekly jobless claims will be announced.