With the holiday season approaching, investor risk appetite is growing, and thus the dollar's price is declining. Accordingly, the EUR/USD stabilized around and above the 1.2200 resistance as of this writing. Bulls are preparing to test stronger levels. What weakens the pace of gains is the continuing fears that the emergence of new strains of the coronavirus may impede global efforts to use the vaccines that recently appeared and gave a glimmer of hope to the world that 2021 will be the year of recovery from the disease and the start of the global economic recovery.

US durable goods orders for the month of November outperformed the expected change by 0.6%, with the rate at 0.9%. Personal spending for the month of November also came in below -0.2% at -0.4% while personal income declined -0.3% with a further decline of -1.1% (monthly). The Core PCE Price Index for November missed both the monthly and annual forecasts of 0.1% and 1.5%, respectively, with 0.0% and 1.4%, respectively.

The Michigan Consumer Confidence Index for December fell below expectations of 81.3, at 80.7. November's new home sales missed expectations (monthly) at 0.995M with a reading of 0.841M, while October's Home Price Index rose 1.5% (monthly) compared to the prior change of 1.7%. Both the initial and continuing jobless claims beat expectations of 885 thousand and 5.558 million, with recording 803 thousand and 5.337 million, respectively.

All in all, the data results showed some optimistic signs while many indicators were unfortunately disappointing. The US Labour Department said fewer American workers filed for unemployment benefits last week. But the number is still incredibly high compared to what it was before the pandemic, although still better than what economists had expected. Another report said that orders for sustainable goods increased more than expected last month, a good sign for manufacturers in the country. But other reports were darker. Consumers decreased their spending last month by more than economists had expected. It was the first decline since April and was mainly attributed to income falling sharply in November, more than economists had expected.

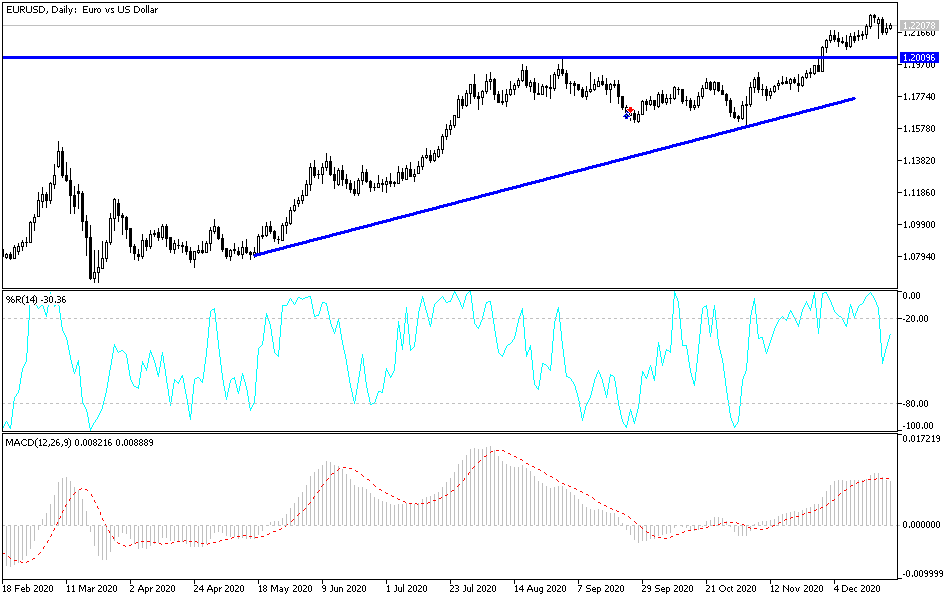

Technical analysis of the pair:

Relatively calm movements are expected in the Forex market trading today, with the economic calendar being empty of important and influential economic releases from the Eurozone or the United States of America.

In the short term, and based on the performance on the hourly chart, the EUR/USD pair appears to be trading within the formation of an upward channel. The pair is currently holding between the 100-hour and 200-hour simple moving average lines. Accordingly, the bulls are looking to extend the current retracement towards 1.2226 or higher to 1.2267. On the other hand, the bears will be looking to pounce on short-term pullbacks around 1.2141, or down at 1.2104.

In the long term, and based on performance on the daily chart, it appears that the EUR/USD is trading within a steep upward curve amid increased upward pressure. This indicates a strong long-term bullish bias in market sentiment. The pair is also closer to the overbought levels of the 14-day RSI. Therefore, the bulls will look to extend the current uptrend towards 1.2394 or higher to 1.2563. On the other hand, the bears will target a long term pullback at around 1.2023 or lower at 1.1810.