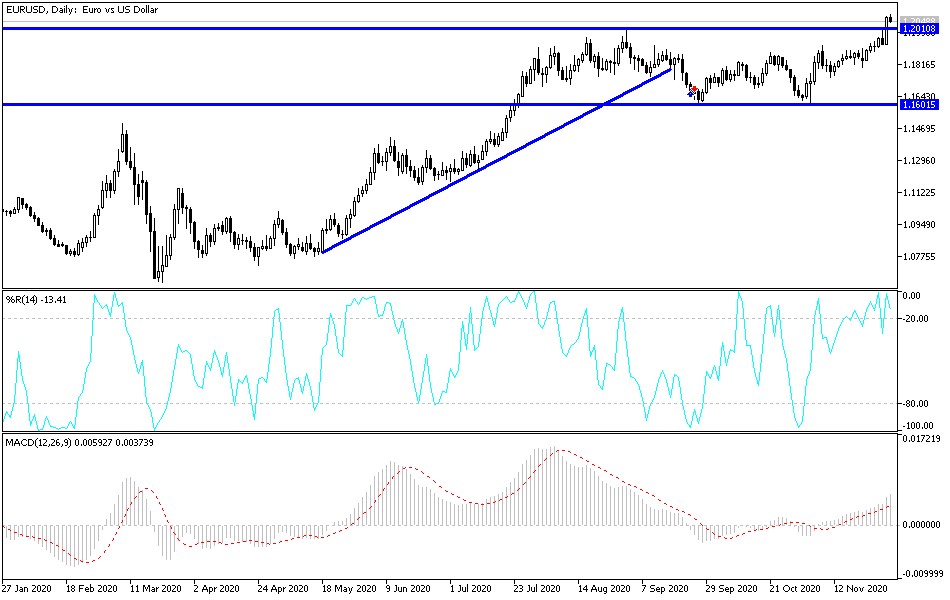

For three trading sessions in a row, the EUR/USD pair stabilized around and above the 1.2000 psychological resistance. The pair made retracement gains that pushed it towards the 1.2083 level before settling around 1.2065 at the time of writing, awaiting any developments. As I mentioned before, the upward correction gains were supported by high success rates for coronavirus vaccines and the outcome of the US presidential election. Therefore, investors abandoned the US currency as a safe haven and the journey to the risk appetite started again. The EUR/USD exchange rate entered the last month of 2020 by knocking on the door of the psychologically important 1.20 area, yet analysts at two investment banks say that patience is required, and a coordinated move above the 1.20 level is still important for 2021.

"The short-term outlook for the EUR/USD pair remains burdened with some uncertainty as the second wave of the corona pandemic continues to pose a threat to the economic recovery," says David Cole, Chief Economist at Julius Baer.

The euro rose during the month of November, moving from a low of 1.16 to a high of 1.20 on Monday, December 1st. The resistance barrier at 1.20 was tested once in September, but the subsequent failure here led to a rollback and a stability period.

Analysts at Bank of America (BofA) told clients in a recent briefing of Forex expectations that a break above the 1.20 resistance would be premature, at least for now. "We expect a drop in the EUR/USD until the end of the year," says Ben Randall, an economist at Bank of America. "It appears that high market volatility, consistent with increased cyclical risks and a lack of policy support, is a necessary condition for a stronger US dollar in the near term."

Official data showed that the German unemployment rate decreased in November, despite the partial lockdown that was implemented to stop the sharp rise in coronavirus infections. However, it is estimated that the number of companies using the short-term payroll support program has increased. Accordingly, the Federal Labour Agency said that the unadjusted unemployment rate, the main figure in Germany, fell to 5.9% last month from 6% in October. The number of people registered as unemployed was just under 2.7 million, 61,000 less than the previous month but 519,000 more than the previous year.

In seasonally adjusted terms, the unemployment rate fell to 6.1% from 6.2%.

High unemployment rates in Germany, which has the largest economy in Europe, was moderate by international standards. This is because employers make extensive use of payroll support programs, often referred to as "leave schemes", which allow them to keep employees on payroll while they wait for better times. In Germany, the Employment Agency pays at least 60% of the salaries of employees who work reduced or zero hours.

On November 2nd, Germany began a partial lockdown that has led to the closure of restaurants for everyone except fast food and delivery, as well as bars, entertainment, and sports facilities. Hotels are not permitted to accommodate people on tourist trips. Unnecessary shops will remain closed. The lockdown was extended last week until at least December 20, because new infections in Germany had stabilized but did not decrease.

The Employment Agency also said that "a lot more" people were enrolled in the German salary subsidy program in November than in previous months. Citing a survey of nearly 7,000 companies, the Ifo Institute said that the percentage of companies using the payroll subsidy program rose in November for the first time in months, to 28% from 24.8% in October.

The Employment Agency said it paid support to 2.22 million people in September, which is its latest data. This was down from 2.55 million in August and about 6 million in April, when the numbers peaked. In September of last year, only 75,000 people were enrolled in the program, which has been around for years. Germany has a population of 83 million.

Technical analysis of the pair:

The EUR/USD currency pair remains stable above the psychological resistance at 1.2000, supporting the current upward trend. After recent gains and the arrival of technical indicators to overbought areas, more momentum is expected to complete the test of higher peaks, or we will witness profit-taking selling at the current time. On the downside, the 1.1800 support remains the most important for bears to reclaim control of performance. Today, the currency pair awaits the German retail sales announcement, followed by the producer price index and the unemployment rate in the Eurozone. From the United States of America, the ADP reading of US non-farm jobs will be announced, followed by Federal Reserve Governor Jerome Powell's testimony.