Since the beginning of this week’s trading, the bulls have had a stronger control over the EUR/USD performance. The pair's gains reached the 1.2108 resistance, its highest level since April 2018, and stabilized around 1.2096 at the beginning of Thursday's trading. I expect the pair to hold on to its gains until the US jobs numbers are announced on Friday, which will paint a picture for closing trades this week. Coronavirus vaccine news and the start of obtaining official licenses for distributing them continues to support the euro and the risk appetite in global financial markets in general.

With the year 2021 approaching, investors need to obtain expectations, especially after a year in which financial markets and the world witnessed many surprises caused by the coronavirus. From these world-famous forecasts, Forex strategists at Morgan Stanley are looking to buy any dips in the EUR/USD exchange rate in 2021, but they warn that the exchange rate approaching the 1.20 level may provoke a response from the European Central Bank in the near term, and it might make the upward trajectory vulnerable to fluctuations in the near term.

In this regard, Matthew Hornbach, analyst at Morgan Stanley, said: “We expect the DXY dollar index to weaken by 4% by the end of 2021. The weakness of the US dollar began to grow in the first half of 2011. The recovery of global growth due to monetary adjustment and the availability of a COVID-19 vaccine supports a weak US dollar.” Recently, the EUR/USD exchange rate moved towards the psychological peak at 1.2000, which is a technically and fundamentally important level. Technical importance in the medium-term charts shows resistance around this point. It is important mainly because it is believed to be the threshold beyond which European Central Bank members become uncomfortable with the strength of the euro's exchange rate.

The Chief Economist at the European Central Bank, Philip Lane, said that when the pair tested the 1.2000 resistance in the recent past, the central bank was watching the rally with interest, leading some market participants to interpret this as a sign that the European Central Bank will act against a rapid rise in the euro. Some analysts attributed the subsequent bearish turn to Lynn's comments, and have since indicated that the 1.20 level represents an end to the EUR's bullish potential. Accordingly, Hornbach says: "The European Central Bank is likely to be cautious about the strength of the euro above 1.20 if economic activity hasn’t improved yet."

However, analysts at Morgan Stanley say that the European Central Bank will ultimately not be able to halt the advance of the EUR, largely because the main driver behind the bullishness of the EUR/USD is the weakening of the dollar. Morgan Stanley predicts a possible 4.0% drop in the DXY Index - a broad measure of overall dollar performance - as a result. “Liquidity from global central banks is still abundant and expanding, while supportive government financial spending should help risky assets rise, especially in the first half of 2021. The US dollar tends to weaken when global growth is strong, which is what we expect too,” Hornbach added.

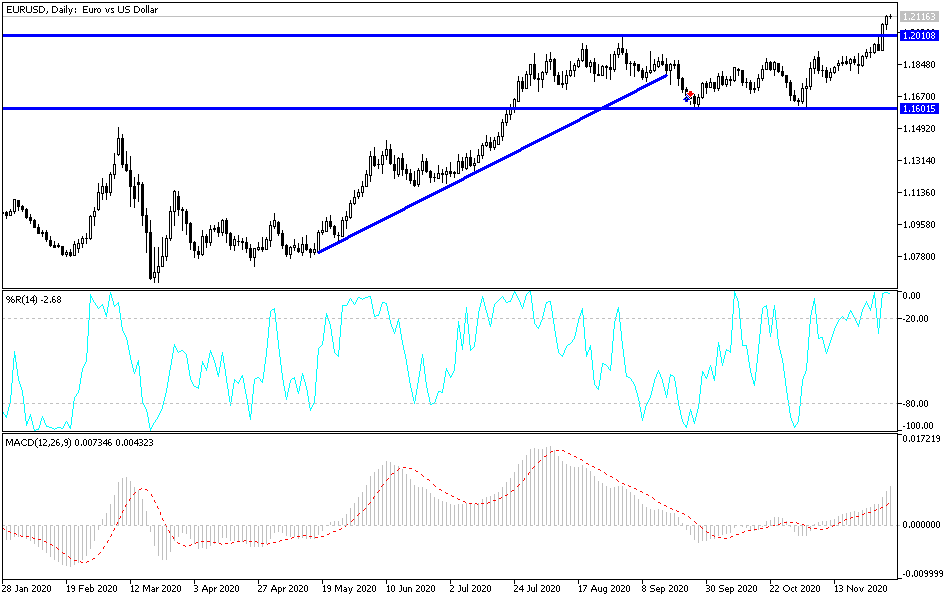

Technical analysis of the pair:

Until now, the bulls' control over the EUR/USD performance is still stronger. Breaking the psychological resistance at 1.2000 and the lack of comment on that from the monetary policy officials of the European Central Bank pushed the bulls to overcome the next psychological resistance at 1.2100 on the daily chart, and technical indicators moved into overbought areas. Until there is no comment from the European Central on the strength of the euro and its damage to the European economy, there may be sales to reap profits at any time. On the downside, after the recent gains, the 1.1855 support level will be the most important for the time being to move in order to reverse the current bullish outlook.

Today's economic calendar:

The PMI reading will be announced for the services sector, followed by retail sales from the Eurozone. In the United States, the jobless claims will be announced and the US services ISM PMI will be read.