The EUR/USD pair may maintain its recent gains pending the monetary policy decisions from the US Federal Reserve, which will be announced later on Wednesday. The currency pair settled around the 1.2168 resistance, near its highest level in two-and-a-half years, amid a wave of optimism that prevailed in the financial markets recently since announcements of the development of coronavirus vaccines. The Pfizer vaccine is still the favourite in the official approvals and is already being distributed around the world.

With strong pressure from Germany and other European Union countries, the Medicines Agency of the bloc moved up the date for a meeting to evaluate Pfizer's coronavirus vaccine to December 21, so it is likely that vaccines will contribute to saving millions of European Union citizens. In this regard, the agency commented by saying that it made the decision after receiving additional data from vaccine makers. The announcement came after the German Minister of Health and others publicly called on the agency to move faster than its previously scheduled meeting on December 29, at which they were to discuss the vaccine approval.

The vaccine is already being given daily to thousands of people in Britain, Canada and the United States, to the dismay of some Europeans who noted that BioNTech is a German company.

The European Medicines Agency also said that it would "conclude its assessment as soon as possible and only once the data on vaccine quality, safety and efficacy are strong and complete enough to determine whether the benefits of the vaccine outweigh the risks." After the commission recommended marketing authorization, the European Union's executive committee will "quickly track the decision-making process" to grant approval for the vaccine to all 27 EU countries within a few days. German Health Minister Jens Spahn told reporters earlier Tuesday in Berlin: "Our goal is to agree before Christmas. We want to continue vaccinating this year."

When the Associated Press asked him if he had received direct confirmation that the vaccine would be approved by December 23, Span said he agreed: "Otherwise I wouldn't have said it."

The European Central Bank maintained its monetary policy with a zero interest rate decision and increased its bond purchases, while pledging to monitor the Forex market after the recent euro gains. Today, the Federal Reserve is expected to maintain US interest rates, and more attention will be given to the content of the bank’s monetary policy statement and comments from Governor Jerome Powell.

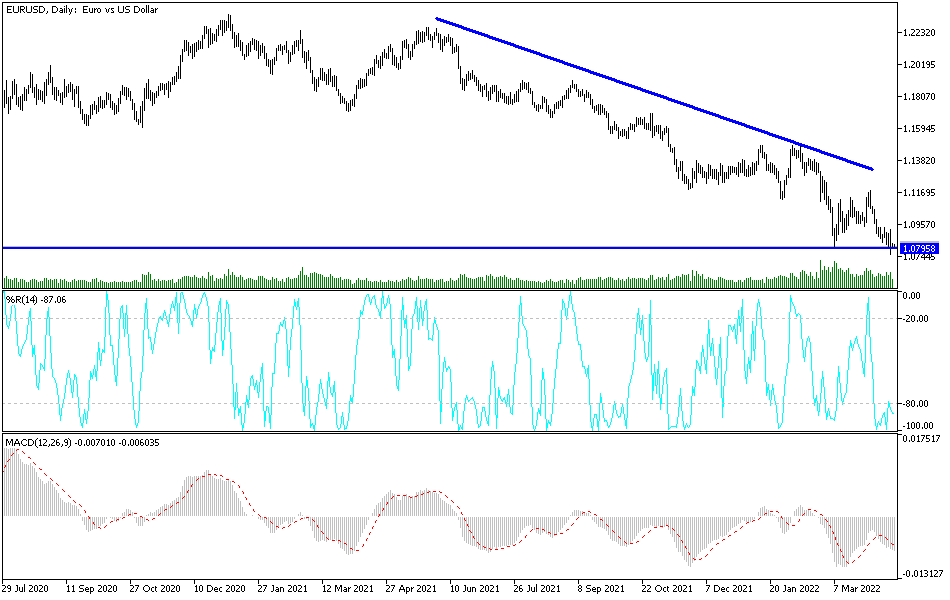

Technical analysis of the pair:

On the daily chart, the EUR/USD is still stable around its strong gains and is waiting for a new momentum to complete its gains or activate the profit taking sell-offs, which are technically long-awaited because the technical indicators are still in overbought areas. Failure to quickly agree to US stimulus halted gains in the pair for some time. Increased optimism among investors means more risk appetite and thus more gains for the currency pair. The closest targets for the bulls are currently at 1.2190, 1.2255 and 1.2330, respectively. On the other hand, if investors accept safe havens again, it will be in the interest of the US dollar, and thus the currency pair moves towards support levels at 1.2090, 1.2000 and 1.1935, respectively.

Today's economic calendar:

For the EUR, Manufacturing and Service PMI readings will be released. For the USD, we have retail sales, Industrial and Service PMI readings, and the monetary policy decisions of the US Federal Reserve and comments of Governor Jerome Powell.