In recent technical analyses of the EUR/USD, we noted that recent gains pushed the technical indicators into overbought areas. With preparation for an important meeting of the European Central Bank later this week, the euro may witness some profit-taking sales. That is what happened at the beginning of this week's trading, as the pair retreated to the 1.2078 support after recent gains pushed it to the 1.2177 resistance, its highest level since April 2018. The pair is holding around the 1.2117 level at the time of this writing. The euro's rise last week came after Britain approved the Pfizer and BioNTech vaccine for the coronavirus, which sparked more joy among investors to boost their expectations for a global economic recovery in 2021.

But political pessimism, including the dispute between the European Union, Poland and Hungary, as well as the apparently growing threat of a "no-deal" Brexit, threatens to pollute the bullish atmosphere for the euro before the European Central Bank’s decision next Thursday. The ECB may be seen as trying once again to reduce the value of the euro exchange rate from its highest level in three years. Said TD Securities: “The risks to the US dollar tend to be bullish as it appears that short positions are extended, and the US dollar is increasingly trading at a discount from its short-term engines. Simply put, we believe that the EUR's rally has far exceeded the fundamentals and, as a result, we are now fading the movement and entering a short position at 1.2165, targeting a downward move to 1.18 with an expected one-month horizon.”

It is usual in financial markets to have a prophecy of the so-called Santa Clause rally that raises stock markets and positively correlated currencies such as the euro during December and January, but if Christmas does not come early in December, it may be at risk of not coming at all at the end of 2020.

Therefore, Christmas or the Santa Clause rally can be cancelled at least if TD Securities is right in expecting the EUR/USD to fall to 1.18 by the end of the year.

Whether or not that is the case depends in part on whether British and EU negotiators are able to strike a deal in the last moments of their talks, because without that, British Prime Minister Boris Johnson might declare that there is a "no-deal" Brexit. This would be disastrous for the sterling and the euro together.

The euro fell by 500 points from 1.1420 to 1.0912 on the 24th of June, 2016, as the Brexit vote became evident in the UK, so we may not accept any decision in favour of one of the most dangerous forms of Brexit from an economic point of view.

Commerzbank technical analysts said on Friday that they still favour an eventual rise for the EUR/USD towards 1.26, but its collision with the Fibonacci level is likely to lead to a period of "stability" that may include a pullback towards its lows in late November.

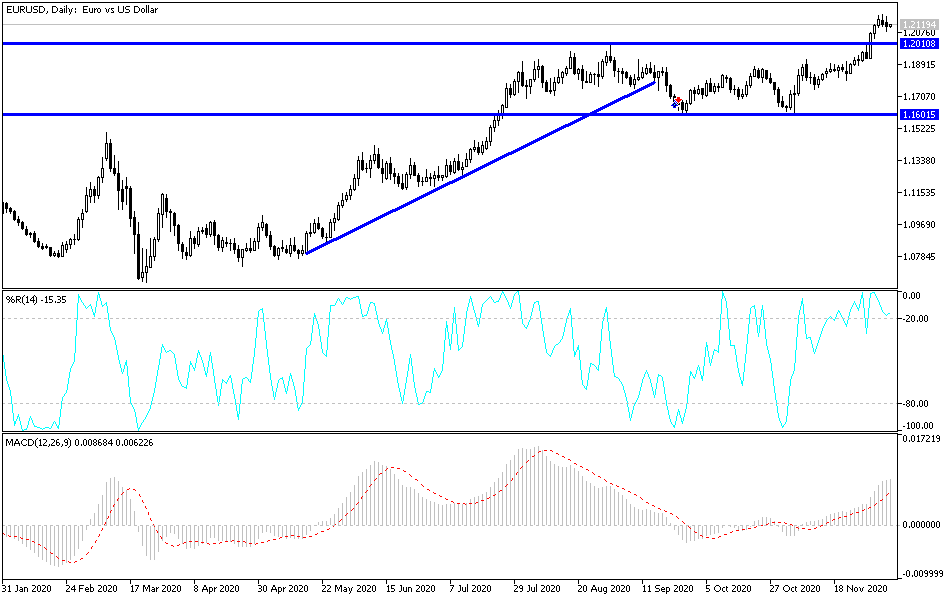

Technical analysis of the pair:

On the daily chart, it is clear that the EUR/USD currency pair is preparing for new selling operations, especially if it stabilizes below the 1.2080 support. Psychological support at 1.2000 is still important for bears to control the performance again. On the upside, resistance at 1.2285 is the next leg of the bulls according to the performance on the daily chart.

Today's economic calendar data:

Regarding the euro, the GDP growth rate for the Eurozone and the German ZEW index reading will be announced. For the USD, the non-agricultural productivity rate and the Cost ofEemployment Index will be announced.