Similar to last week’s performance, the EUR/USD pair completed the upward correction, which is the closest to the last resistance level of 1.2177, its highest since April 2018. The pair is waiting for any developments in investor’s risk appetite following the approval of coronavirus vaccines and ahead of economic releases. After recent gains, fundamental and technical analysts expect the pair to head towards new highs for the year 2020 after the euro succeeded in navigating a wave of political and economic fluctuations, in which COVID-19 was a major factor.

The European Central Bank commented on recent euro gains stating that it would only monitor the currency exchange market and did not take new steps, which contributed to the upward stability of the euro. According to the European Central Bank (ECB) announcement, monetary policymakers introduced a €500 billion extension to the European Central Bank's quantitative easing program that markets had anticipated. The ECB made little comment on recent moves in the Forex market, in an update that was seen in some parts as a green light for another increase in the EUR/USD rate.

Commenting on this, Andreas Steno Larsen, Senior Forex Analyst at Nordea Markets, says: “We remain bullish in emerging markets as we find that the European Central Bank has paved the way for the 1.25 level for the EUR/USD pair. The European Central Bank has been on high alert without any real threat to cut interest rates (good news for the euro speculators), and the two Brexit negotiations parties have not yet agreed on any deal as a base case (is it time to buy the pound sterling again?). Emerging market bets continue to perform in an impressive 2021 anticipation. We've spoken time and time again about the potential meltdown of risk assets in 2021 due to too much money chasing very few assets after the pandemic. Therefore, it can be said that we are already in 2021.”

Peter Carpatta, Chief Forex Analyst at ING, said: “Without Brexit, we believe the EUR/USD pair would be trading at 1.23 now. It is assumed that the British pound will drag the euro around driven by any progress - or lack thereof - in the Brexit discussions. But looking at: a) the dollar's strong bearish trend and b) after the European Union leaders approved the 2021-27 budget and recovery fund, c) after the European Central Bank meeting has passed, we believe that the EUR/USD pair should remain supported."

In general, the optimism related to vaccines and the political gains of Brussels with regard to Brexit, as well as the coronavirus recovery fund and the budget for the next seven years, may enable the euro to overlook the negative effects of the growth prospects in the last quarter stemming from Germany's decision over the weekend to tighten virus restrictions before the festive holiday. German leaders have ordered non-essential stores and schools to close again from Wednesday amid a rapid spread of the infection. Schools were already scheduled to close as a result of the holidays while restaurants and bars had already closed their doors as well, though the impending closure of Germany's remaining major street businesses still led to a downward revision of growth prospects for Europe's largest economy.

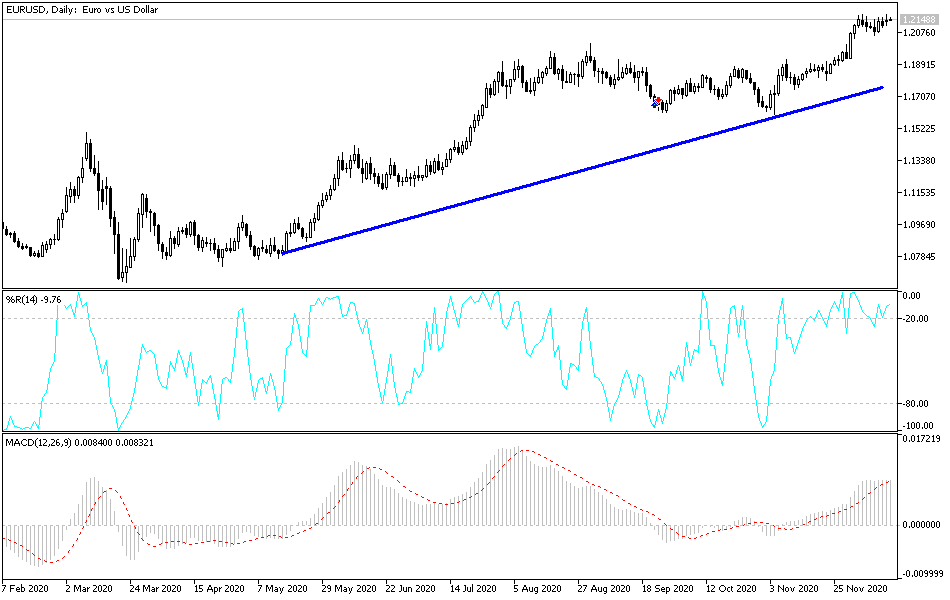

Technical analysis of the pair:

According to the performance on the daily chart, the EUR/USD is still in an upward channel range and is waiting for more momentum to complete the upward rise. The failure of this means that the sales operations to reap profits will be closest, as technical indicators have reached overbought areas after recent gains. Selling targets might be at the resistance levels of 1.2190, 1.2255 and 1.2320, respectively. On the downside, the 1.1985 support will be the most important for bears to start their launch. Along with the extent of investor’s risk appetite, the pair will be affected today by the announcement of the US economic data, including the Empire State Industrial Index reading and the US industrial production rate.