The EUR/USD pair's correction gains culminated upwards by testing the 1.2177 resistance, the highest for the currency pair since April of 2018, before closing the week’s trading and stabilizing around 1.2120. The pair's gains are supported by the decline of the US dollar and the continued turnout of investors to take on risk, especially with coronavirus vaccine developments giving investors a glimmer of hope. Britain became the first country in the world to authorize the rigorously tested COVID-19 vaccine last week. Italy recorded more than 21,000 cases of coronavirus daily and added 662 deaths during the past 24 hours.

Accordingly, the 21,052 new cases brought the total cases in Italy to nearly 1.6 million. There were 59,514 confirmed deaths, the second-highest toll in Europe after the death toll in Britain. Accordingly, Italian Prime Minister Giuseppe Conte signed a decree restricting travel between regions from December 21 to January 6, which is the national holiday of Epiphany. Conte hopes to prevent vacations that could fuel infection.

Commenting on the future gains of the euro, Kjersti Haugland, Chief Economist at DNB Markets said: “The appreciation of the euro is an additional incentive for the European Central Bank to increase quantitative easing.” A recent ECB research note concludes that quantitative easing has a significant and continuing impact on the EUR/USD currency pair. “We expect the PEPP to increase in size and duration. Moreover, we expect to announce new rounds of TLTROs (Targeted Long-Term Refinancing Operations) for banks, with easy access and terms,” he added.

The euro’s moves will focus on the ECB’s decisions, as the European Central Bank is scheduled to announce its latest monetary policy decision at 12:45 London time next Thursday, December 10, although markets will focus more on the statements of Bank Governor Christine Lagarde Walt during a press conference at 13:30 on the same day. In October, Lagarde said the bank would reset all instruments in response to the recent continental shutdown to contain coronavirus infections, which meant it would expand the quantitative easing program and potentially reduce the already negative deposit rate from the current -0.5%.

As part of renewed restrictions amid the recent spike in new coronavirus cases, the US Labor Department released a report showing US job growth slowed by much more than expected in November. Accordingly, the ministry announced that employment in the non-agricultural sectors rose by 245,000 jobs in November after it jumped by 610,000 jobs, revised downward, in October.

Economists had expected an increase in employment of 469,000 jobs compared to an addition of 638,000 jobs originally reported for the previous month. The weaker-than-expected job growth is partly due to the loss of 99,000 government jobs amid a decrease in the number of temporary census workers.

At the same time, the report also showed a decline in retail employment as well as a significant slowdown in the pace of job growth in the entertainment and hospitality sector. The Ministry of Labour added that the increase in employment in November reflects remarkable job gains in transportation, warehousing, professional and commercial services and healthcare. Despite weaker-than-expected job growth, the report said the unemployment rate fell to 6.7% in November from 6.9% in October. The unemployment rate was expected to drop to 6.8%.

However, the larger-than-expected decline in the US unemployment rate came as the decline of 400,000 in the workforce far exceeded the decline of 74,000 in the home employment gauge. Commenting on the results, Michael Pearce, Chief US Economist at Capital Economics, said: “This latest decline is not a big concern given that it comes after an increase of 2.3 million in October, but the decrease in the workforce, which is now 4 million below the pre-epidemic level, is a worrying sign that the unemployed are giving up in search of work.”

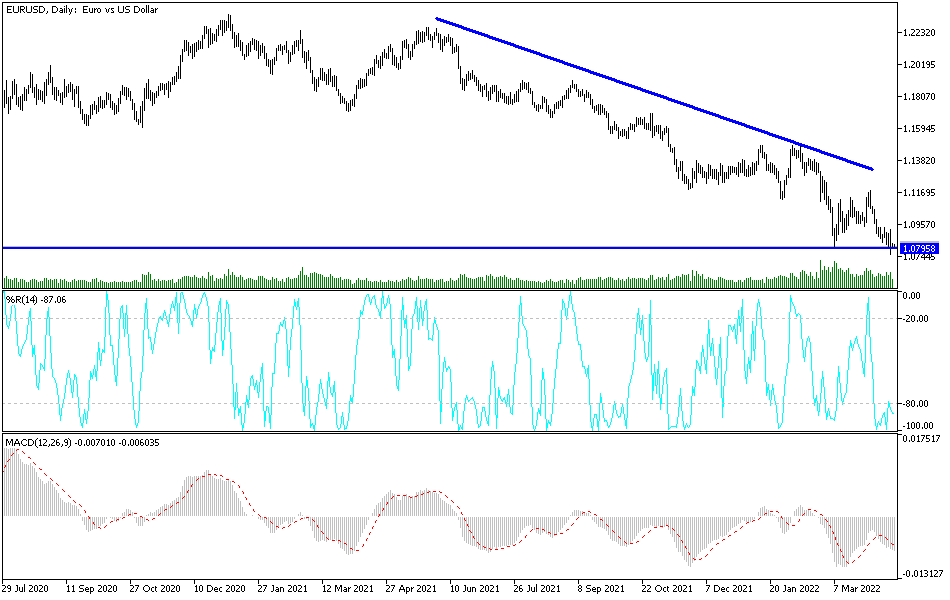

Technical analysis of the pair:

On the daily chart, the EUR/USD price is still in the range of an upward correction. The technical indicators give signals of overbought areas, and any comment received from the European Central Bank about the rise in the euro exchange rate will increase the chances of profit-taking sales. So far, the most important resistance levels for the pair's performance are still 1.2185, 1.2235 and 1.2300, respectively. On the downside, the 1.1790 support level is still the most important for bears to return to control performance in the coming period.

Today's economic calendar data:

There are no significant releases expected today from the US. From the Eurozone, German industrial production and the Sentix Investor Confidence Index reading will be announced.