For four trading sessions in a row, the EUR/USD currency pair was exposed to limited selling operations that pushed it towards the 1.2130 support before settling around the 1.2185 level at the beginning of the year's last week of trading. Recent gains pushed it towards the 1.2272 resistance, its highest since April of 2018. This came amid the USD's collapse as investors took risk following the coronavirus vaccines and their distribution. However, there emerged new strains of the virus that spread faster, leading to more restrictions to contain the pandemic, especially with the addition of winter's seasonal flu, whose symptoms are similar to those of the coronavirus. This allowed the safe-haven dollar to achieve some gains until the wave was declared contained.

Germany, Hungary and Slovakia began providing the first vaccine against the coronavirus at the beginning of this week, just hours after receiving their first shipments, which disturbed the European Union’s plans to coordinate its deployment on Sunday across the 27 EU member states. In this regard, the German news agency DPA reported that the first person to be immunized with the Pfizer-Bio-Tech vaccine was Edith Quesala at 101 years of age.

The first shipments of the vaccine arrived at hospitals across the European Union in very cold containers late Friday after being dispatched from a manufacturing centre in Belgium just before Christmas. For her part, European Commission President Ursula von der Leyen released a video clip to celebrate the launch of the vaccine in the bloc that includes nearly 450 million people, describing it as a "moving moment of unity."

“Today, we begin to turn the page in a difficult year. The COVID-19 vaccine has been delivered to all European Union countries." She added that vaccinations will begin tomorrow across the European Union.

The launch marks a moment of hope for a region that includes some of the world's oldest and most dangerous areas affected by the virus - Italy and Spain - and others like the Czech Republic, which were averted early only to see healthcare systems near their breaking point in the fall. All in all, European Union countries have recorded at least 16 million coronavirus infections and more than 336,000 deaths - huge numbers that experts agree still underestimate the true losses of the pandemic due to missed cases and limited testing.

However, the launch of the vaccine helps the bloc project feel lonely in a complex mission to save lives after it faced a year of difficulties negotiating a post-Brexit trade deal. It also brings relief to European Union politicians who were frustrated after Britain, Canada and the United States began vaccination programs earlier this month with the same developed German vaccines.

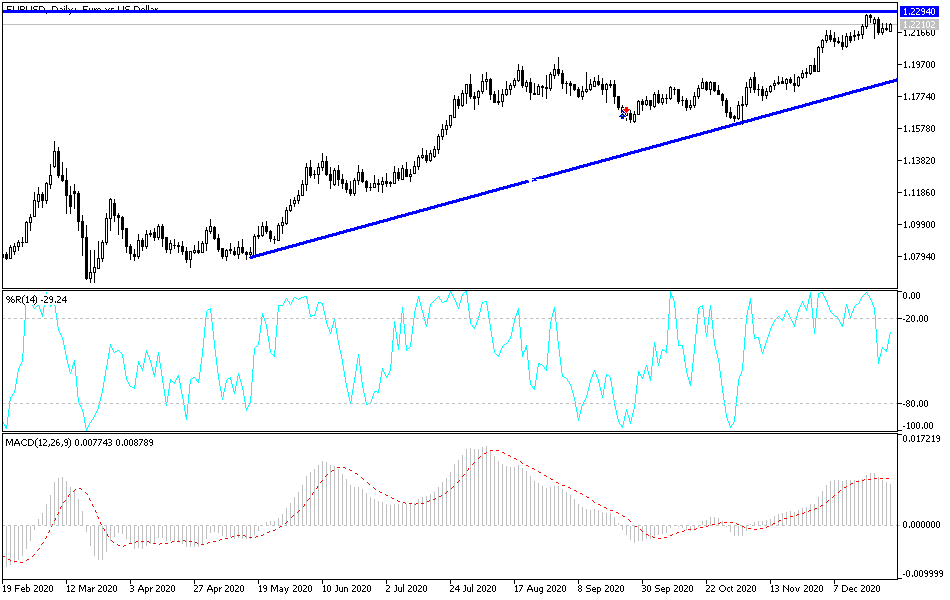

Technical analysis of the pair:

As of now, and according to the performance on the daily chart, the EUR/USD currency pair can still continue its rise if it is stable above the 1.2000 psychological resistance. A break of the 1.2200 resistance still motivated the bulls to achieve more. After the expected gains, the closest of which are currently, 1.2235, 1.2340 and 1.2400, respectively, investors may turn to evaluate the economic performance of Europe and America in the coming period. To the downside, the bears will not be in control without breaching the 1.2000 support. It must be considered that the movements of the currency market this week may not be stable due to poor liquidity and the reluctance of investors to trade until the markets return to their full nature.