For five trading sessions in a row, the EUR/USD pair has been subjected to profit-taking selling operations. This comes in preparation for the monetary policy decisions of the European Central Bank today and the reaction to the recent euro gains. The selling pushed the currency pair towards the 1.2058 support before settling around the 1.2100 level at the time of this writing. The correction to the bottom came after strong gains as the currency pair reached the 1.2177 resistance, its highest since April of 2018. The importance of today's move is due to increasing speculation that monetary policy makers at the European Central Bank may indicate the extent of damage from the strength of the euro exchange rate and that it impedes the bank’s efforts to revive the European economy. Despite this, and with news of coronavirus vaccinations, expectations emerged that the EUR/USD may rise further next year. This may reflect the 2015 decline caused by the European Central Bank’s quantitative easing, according to some analysts, although EU leaders will first need to extinguish the pair’s strength erupting decisively from the political fire.

The euro's gains increased against the rest of major currencies as investors bet that the political conflicts raging in Europe were nearing an imminent solution, most notably from the Eurozone. It was reported that Poland, Hungary and German Chancellor Angela Merkel are about to reach a compromise regarding the new conditions for accessing the EU budget funding after a dispute over how to interpret and apply the "rule of law" in Brussels.

The Polish Deputy Prime Minister reportedly said on Wednesday that “the alternative to the United Right government would be early elections that would not serve Poland well during the pandemic” after indicating that an agreement had been reached.

“This should be formalized at the EU leaders’ summit that starts tomorrow,” says Pipan Ray, Forex analyst at CIBC Capital Markets. “The back winds of contractionary trade should boost demand for the EUR/USD as well as the US stimulus package. At the moment, we are watching to see if the market will exit the highs reached at the beginning of the year at 1.2178, which failed to breach over the course of three sessions last week. Weak support comes in at the 1.2080 area.”

Hungary and Poland threatened to veto the next budget of the European Union and the Coronavirus Recovery Fund because of conditions that they fear would be used to impose unwanted European policies by force. However, they risked depriving others of the main funding in addition to a partial shutdown of the government in Brussels.

In general, the euro has already risen by 8% against the dollar this year, which has sparked protests about the deflation that the ECB fears in this process, so its continued rise next year depends largely on the behaviour of other currencies, including the Chinese yuan and the British pound. "Vaccines are good for humanity and the outlook of the global economy, but they are not good for the dollar," says Kit Juckes, Chief Forex Strategist at Societe Generale. “The euro is winning because the dollar is losing, and until then, the degree to which the EUR/USD will rise will depend on how much of the yuan's increase is allowed. Our expectations are that this will act as a brake on the strength of the EUR, but we are above expectations for the EUR/USD pair.”

Broader currency market considerations are important to the EUR/USD outlook. A very strong rally may necessitate a self-defeating policy by the ECB over concerns about deflationary stimulus of cheaper imports, all the while hampering the competitiveness of Eurozone exports. Therefore, a stronger yuan and sterling could mean a strengthening of Europe's two largest trading partners’ currencies, and as a result, increases in the overall exchange rate of the Eurozone are limited even if the euro’s gains against the dollar increase again in 2021.

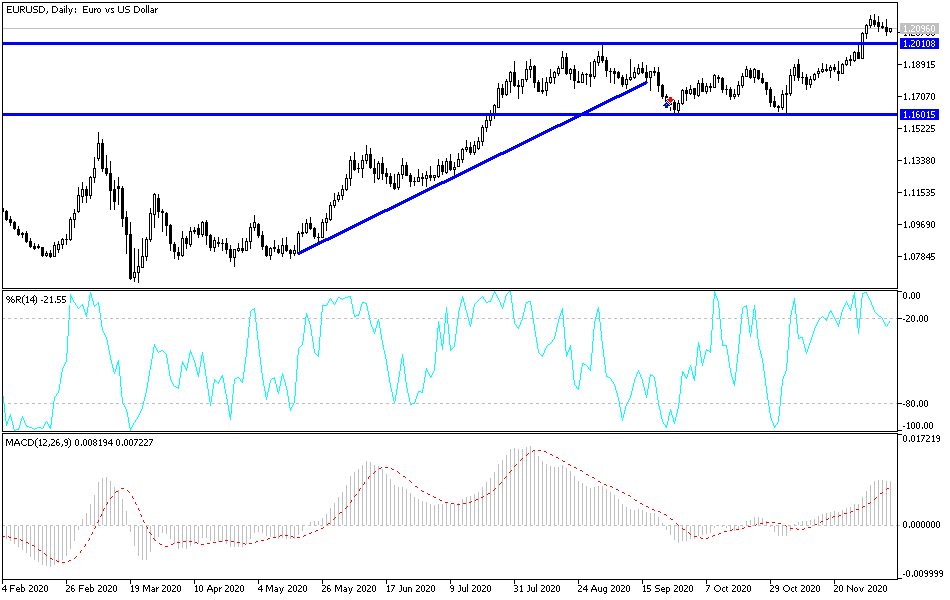

Technical analysis of the pair:

Despite the recent stopping of gains, the EUR/USD still has the opportunity for an upward correction as long as it is stable above the 1.2000 resistance. A break below this level may occur if the European Central Bank indicates the extent of the damage from the recent strength of the euro, and in return, ignoring this will greatly benefit the currency pair in returning to the upside path again. Therefore, the closest resistance levels will be 1.2175, 1.2235 and 1.2340, respectively. On the other hand, moving below the 1.2000 support will increase the bears' control to move towards stronger support levels and thus shake the current confidence in further upside movement.

Today's economic calendar:

In the Eurozone, the most important thing will be the European Central Bank’s announcement of its monetary policy decisions, and at a later time, ECB Governor Lagarde's press conference. In the U.S., the Consumer Price Index and unemployed claims data will be announced.