Recent profit-taking sales pushed the EUR/USD towards the 1.2080 support. Speculation increased that the pair is vulnerable to a move towards the 1.2000 support or below, preparing for an announcement from the European Central Bank's monetary policy meeting tomorrow. Amid fears that the bank will negatively comment on recent euro gains, the pair was pushed towards the 1.2177 resistance, its highest level since April 2018. The pair is holding around the 1.2100 level at the time of this writing. Recent correction was widely expected, as the technical indicators reached strong, oversold areas. The strength of the euro’s exchange value often annoys ECB monetary policy makers because it impedes the bank’s efforts to revive the European economy in the face of the pandemic.

Survey results from ZEW, the Leibniz Center for European Economic Research, showed that German economic confidence improved significantly in December after the announcement of upcoming COVID-19 vaccine approvals. Accordingly, the ZEW Economic Sentiment Index rose more than expected to 55.0 in December from 39.0 in the previous month. The result was expected to advance to 45.5. The economic outlook has largely recovered from the steep decline recorded in November.

Sentiment improved in December, although the number of new coronavirus infections continued to rise. Commenting on the results, ZEW President Akim Wambak said this is most likely due to upcoming approvals for the COVID-19 vaccine.

However, the Current Situation Index decreased to -66.5 from -64.3 in November. This was the second consecutive crash. Economists had expected the index to decline to 66.0. ZEW also said that financial market experts' sentiment regarding economic development in the Eurozone improved significantly more than in Germany, with the index reaching at 54.4 points in December, up from 32.8 in the previous month.

On the other hand, according to revised estimates by the European statistics agency, Eurostat, the Eurozone GDP grew sharply by 12.5% compared to the previous quarter, reversing the 11.7% drop in the second quarter. The growth rate was revised marginally down from 12.6%. On an annual basis, the GDP decreased by 4.3% against a decline of 14.7% in the second quarter. According to preliminary estimates, the GDP dropped by 4.4% in the 3rd quarter.

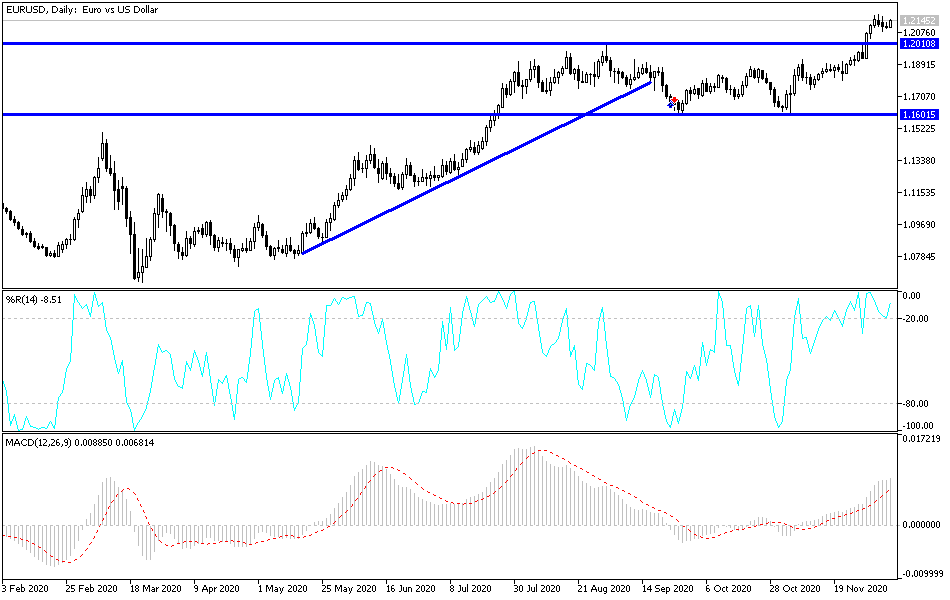

Technical analysis of the pair:

The EUR/USD pair recently breached the key resistance level at 1.1900 and then rose to the 1.2280 area before the upward movement halted. The price may be correcting the support areas that characterize the Fibonacci retracement tool. The 100-SMA remains above the 200-SMA to confirm that the overall trend is still bullish and that support levels are more likely to hold than to be broken. The gap between the moving averages is widening to reflect consolidation of upward momentum.

The 38.2% Fibonacci area is the closest support area and is located near the 1.1950 secondary psychological level. The 50% Fibonacci level is close to the 100-SMA, a dynamic inflection point, while the 200-SMA is close to 61.8% Fibonacci level at 1.1820. The stochastic is turning lower after it recently reached overbought territory, indicating that bears are in control as buyers take a breather. The Relative Strength Index is also pointing down, so the price may follow suit as the oscillator moves down.

The euro may experience a lot of volatility against the US dollar this week as the European Central Bank prepares to announce its monetary policy. No actual interest rate changes are expected, but the central bank may announce an expansion and extension of the PEPP program.