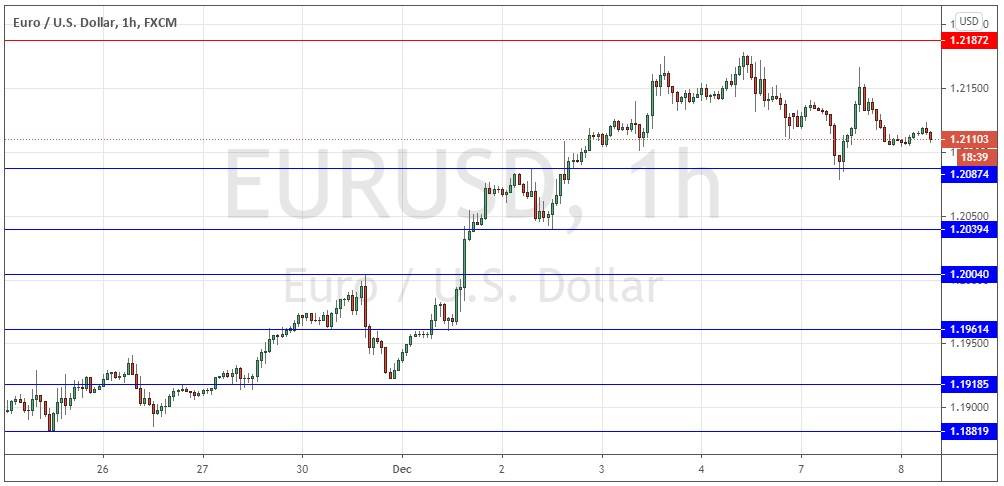

Yesterday’s signals gave a profitable long trade from the bullish bounce off the support level at 1.2087.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

Short Trade Idea

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2187.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2087, 1.2039, or 1.2004.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote yesterday that due to the long-term bullish trend remaining valid, as long as the price stayed above the nearest support level at 1.2087, the odds continued to be in favour of still higher prices here.

This was an OK call as the price made a bullish bounce at 1.2087 yesterday as I was anticipating, and gave about 40 pips or so of profit on any long trade entry.

However, the price action has turned more bearish over the short term, and the price chart below shows that a medium-term bearish head and shoulders pattern has emerged, indicating that the price is most likely to move downwards. However, the key support level at 1.2087 is effectively the neckline of this pattern and it has not been broken yet.

It is likely that we will not see higher prices and will instead get a consolidation of bearish retracement now.

The key thing to watch for is whether the support at 1.2087 continues to hold, although I will not be seeking a long trade from that level today. I would take a long trade from a bounce at the next lower support level t 1.2037.

As there are no resistance levels very close by, I do not see any great short trade opportunities, except in the unlikely case of the price hitting 1.2187 today.

Despite all my technical analysis, there is a fundamental and sentiment issue in the market now concerning whether the E.U. and the U.K. will agree on a trade deal which caused a lot of volatility in the British pound yesterday. Headlines on this issue can also cause unpredictable and volatile price movement in the euro.

There is nothing of high importance scheduled for today regarding the USD, but there are a few minor releases due concerning the euro such as German ZEW Economic Sentiment data.

There is nothing of high importance scheduled for today regarding the USD, but there are a few minor releases due concerning the euro such as German ZEW Economic Sentiment data.