Long trade ideas

Go long the EUR/USD pair ahead of a Brexit deal announcement.

Target the psychological level of 1.2250.

Put a stop loss at the support at 1.2177, which is the December 4 high.

Short trade ideas

Go short if the price moves below 1.2177.

Target 1.2150, which is along the ascending trendline.

Put a stop loss at the current level of 1.2200

The EUR/USD pair is rising today as traders react to a potential Brexit deal, weaker US dollar, uncertainty on stimulus, and mild US economic data. The pair has risen to 1.2200, which is higher than this week’s low of 1.2128.

Brexit deal imminent

After months of heated negotiations, the United Kingdom and European Union are on the verge of reaching a Brexit deal. According to media reports, the two sides have made concessions on key issues like fisheries and regulations.

They agreed on an outline of the deal yesterday, with the chief negotiators set to announce the details of the deal today. Also, Boris Johnson will deliver a press conference today to explain the details of the deal.

In the past few months, the key outstanding issues have been about access to the rich UK waters and fair-trade rules. On fisheries, the UK had demanded to have full authority on who has access to its waters. The EU wanted its fishermen to have this access. On fair-trade rules, the EU wanted UK’s firms to operate in the same set of regulations.

A Brexit deal is a good thing for the euro because it will ensure that trade flows continue after December 31st. The two sides do business worth more than £630 billion every year.

Soft US economic data

The EUR/USD is also reacting to the overall soft US economic data. Yesterday, data from the US showed that the overall durable goods orders rose by just 0.9% in November, lower than the previous increase of 1.9%. Core durable goods orders rose by just 0.4%, the slowest increase since August.

Further data showed that personal income and expenses declined in November. In the real estate market, new home sales dropped by 11% to 841%. On Tuesday, numbers showed that existing home sales also dropped in November. This decline was mostly because of the new lockdowns ordered by several states.

All this happened as Donald Trump threatened to veto a $900 billion stimulus deal passed early this week. He has insisted that payments to individual Americans should be about $2,000, instead of the $600 proposed in the bill.

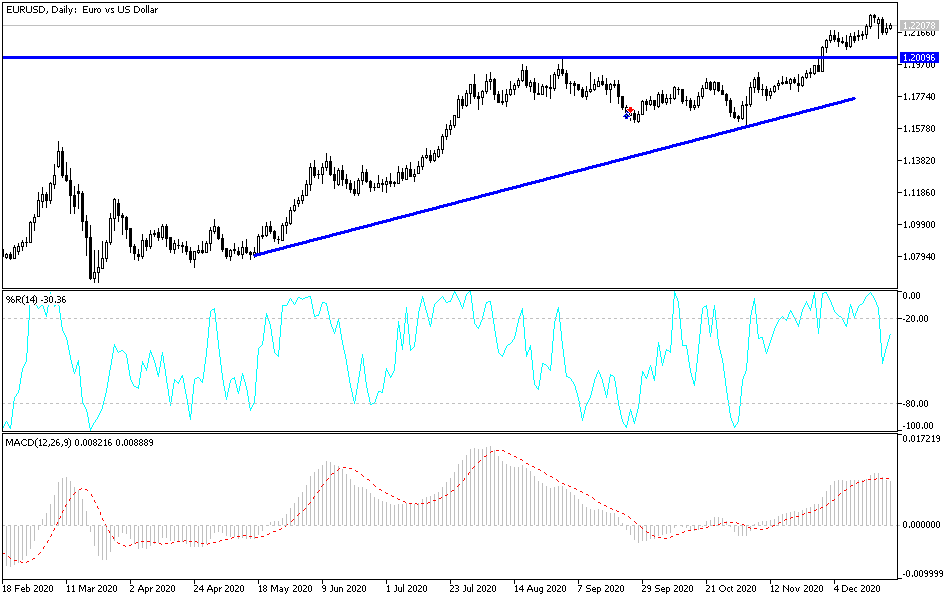

EUR/USD technical outlook

On the four-hour chart, we see that the EUR/USD pair has been in a slow upward trend. It has moved above the 15-period and 25-period weighted moving average (WMA). It has also moved above the ascending blue trendline that connects the lowest levels this week.

Therefore, the pair will possibly continue rising as bulls aim for the next resistance at 1.2250. On the flip side, a move below the support at 1.2177 will invalidate this trend. This was the highest level on December 3 and 4.