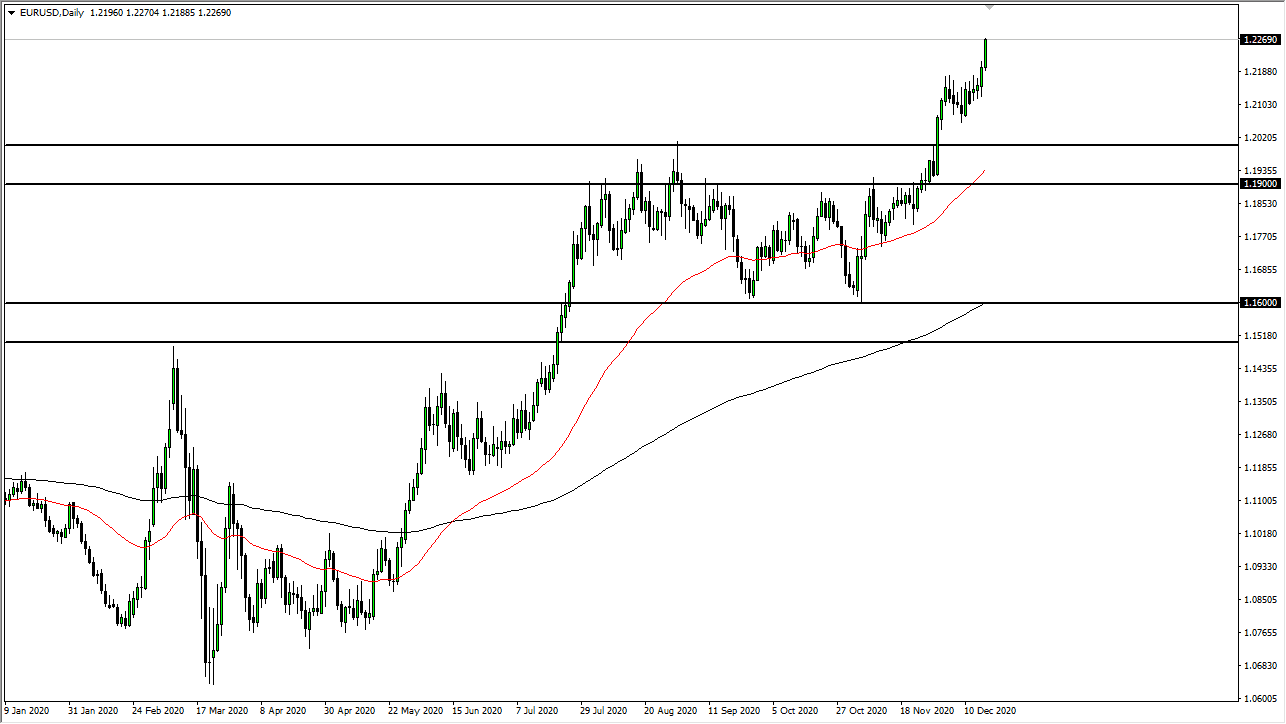

The Euro exploded to the upside during the trading session on Thursday, as we continue to see the US dollar get battered on stimulus hopes. With that being the case, it is very likely that we are going to see a move towards the 1.23 level, an area that has been targeted for some time. After all, we have a significant bullish flag that has just kicked off, and there is a certain amount of selling pressure at the 1.23 level that will have to be tested. With stimulus talks going on in the United States, it is very likely that we are going to see traders trying to reach that level. At this point, I believe that short-term pullbacks will probably be buying opportunities as there is a significant amount of US dollar negativity coming out.

To the downside, I believe that the 1.20 level underneath will be significant support, as it is a large, round, psychologically significant figure. That extends down to the 1.19 level, and therefore I think there is a huge “support zone” in that general vicinity. The 50 day EMA has sliced through that level, so it does suggest that perhaps we are going to find plenty of buyers if we did somehow dropped to that level. I do not think it happens anytime soon though, and therefore it is worth paying attention to any dip as a potential buying opportunity.

As we head into the weekend, it is very possible that we need to see some type of pullback as traders will take a certain amount of risk off the table. That being said though, I do think that it is only a matter of time before buyers would come back so I would welcome that as an opportunity to take advantage of value. All things being equal, I have no interest in trying to short this market, it has been far too strong. If we get more good news coming out of the Brexit situation, that should also continue to help the Euro going forward although it is not a sensitive to it as the British pound is. The size of the candle is somewhat impressive, and we are closing towards the top, so that typically means that there is going to be a bit of follow-through. Having said that, it does not mean that we cannot pull back in the meantime.