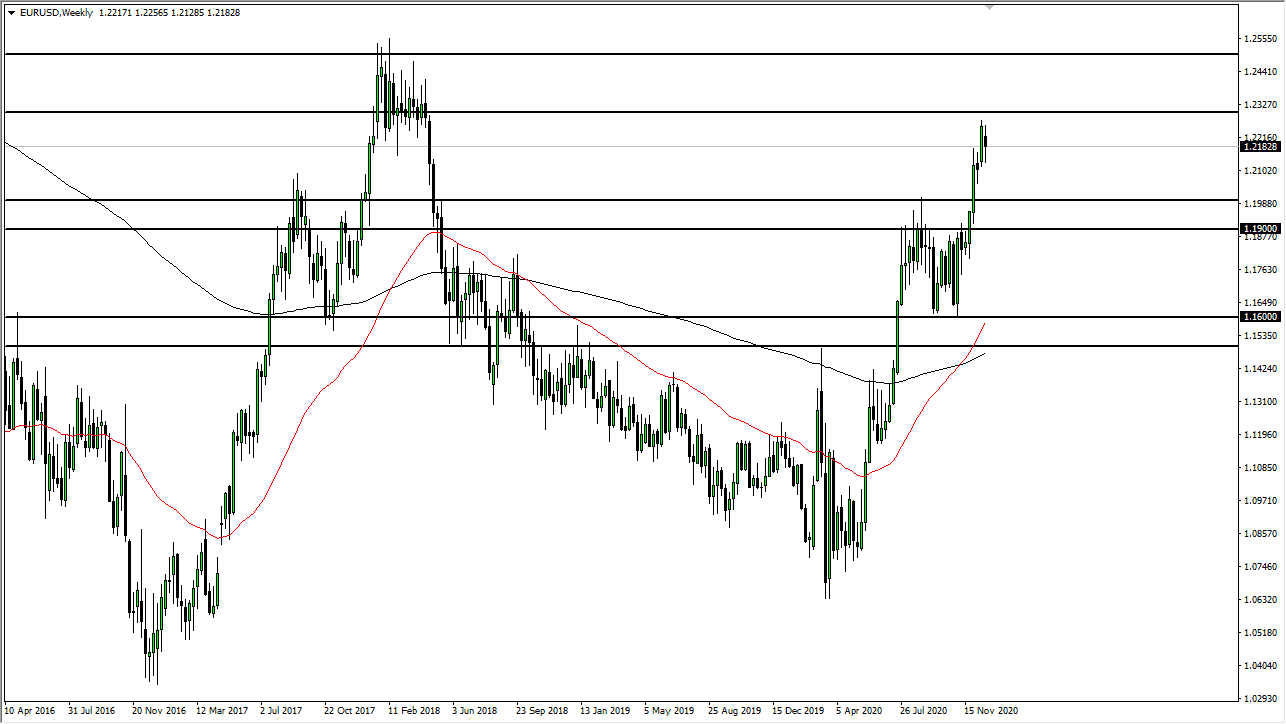

The euro had a relatively good end of the year for 2020, so it is likely that we will see a bit of exhaustion in this general vicinity. As you can see, the month of December was relatively fruitful, and we did break out of a consolidation area just before it. The market is very likely to see exhaustion heading into a significant area in the form of the 1.23 level. We had recently sold off from that level, and it will be difficult to simply shoot straight through it.

The month of January will very likely be a lot of consolidation, as we need to digest some of the gains that we made so rapidly. Keep in mind that the euro does not tend to move very quickly unless we get a catalyst. Yes, we have the Brexit deal signed now, but the euro was always going to be less influenced by the situation as traders, for whatever reason, assumed that the European Union was going to get through it without any major damage. Most of the negativity of course was focused on the British pound, which is in its own world at the moment.

I believe the 1.20 level underneath will probably offer a floor for the month, so one has to pay attention to that entire area between 1.20 and 1.19, which has previously been massive resistance. To the upside, there is a lot of noise between the 1.23 level and the 1.25 level, so it is going to be difficult to break above there until we get a massive “risk on” type of move. This is a market that has gotten ahead of itself, so at this point we will have some digestion heading into the beginning of the year. We will need to see what the stimulus situation in the United States is as well as the coronavirus figures in the EU, which have been rather ugly as of late. I think there will be a significant amount of confusion, and range-bound trading. Keep in mind that the beginning of the year is typically a time when traders put money to work, and it does tend to be choppy regardless.