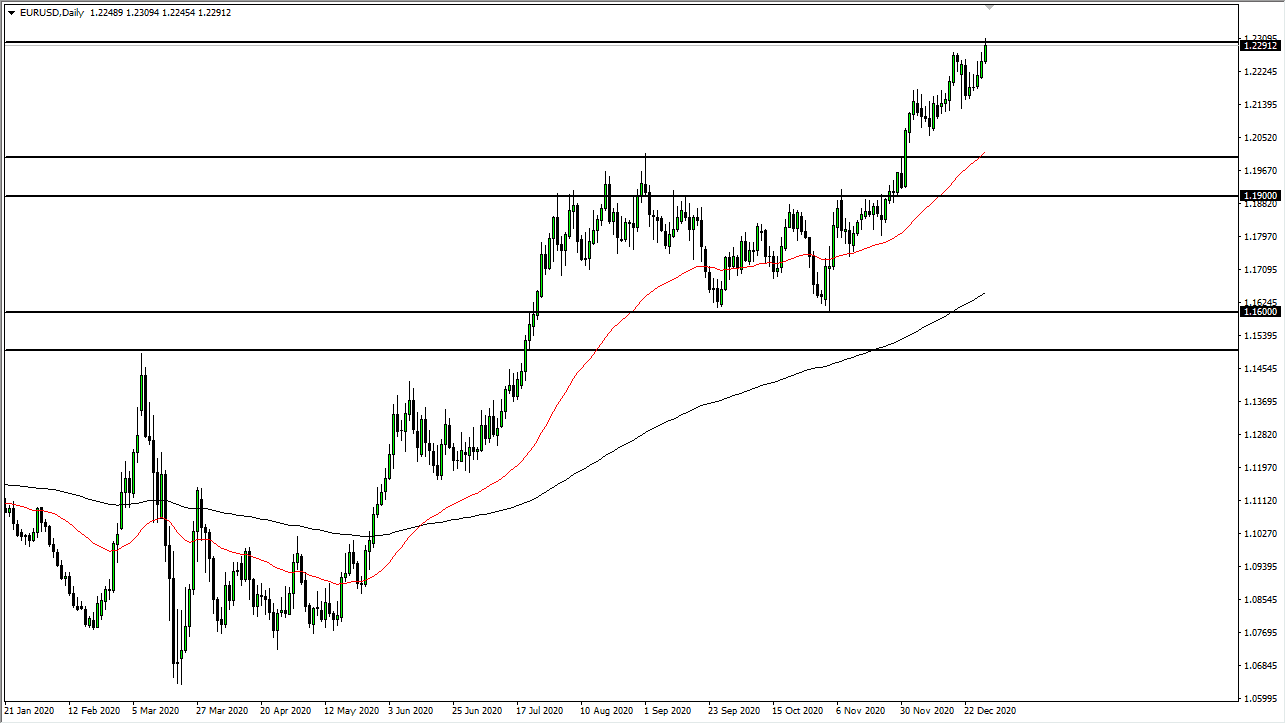

The euro rallied into the 1.23 level, an area of significant resistance that extends to the 1.25 handle. It is also an area that I think will be difficult to break above based on the monthly chart. Nonetheless, I do believe that eventually we will get a resolution, and it certainly looks as if the US dollar is in significant trouble. Because of this, we will break out but in the short term, and we may get the occasional pullback. Those pullbacks will probably be buying opportunities based on the fact that we have seen so much in the way of momentum to the upside.

Keep in mind that stimulus in the United States should continue to devalue the US dollar, which could send this market higher. I think we will get a “buy on the dips” attitude time and time again, until we finally get the catalyst to break out. It is a scenario in which we will hear a lot of noise, but there is plenty of support underneath to keep this market going higher. The 1.20 level underneath will be the “floor in the market”, as it is previous resistance. Furthermore, the 50-day EMA is breaking above there, so it does suggest that we have plenty of buyers in that area as well based upon technical analyses.

The market did pull back a bit from the 1.23 level, which suggests that we do not have the momentum yet. What I find interesting is that the US dollar is getting crushed in general, and now we are squeezing against a major area. It is worth paying attention to the fact that, at the same time, the British pound looks as if it is getting closer to breaking out, so the real trade may not be in this market, it may be in the EUR/GBP pair. Keep an eye on that currency pair and take a look at the US dollar. Pick which one of the European currencies are doing better, and trade it against the greenback. I do believe that the euro will take off to the upside, but this is a major area to pay attention to on longer-term charts.