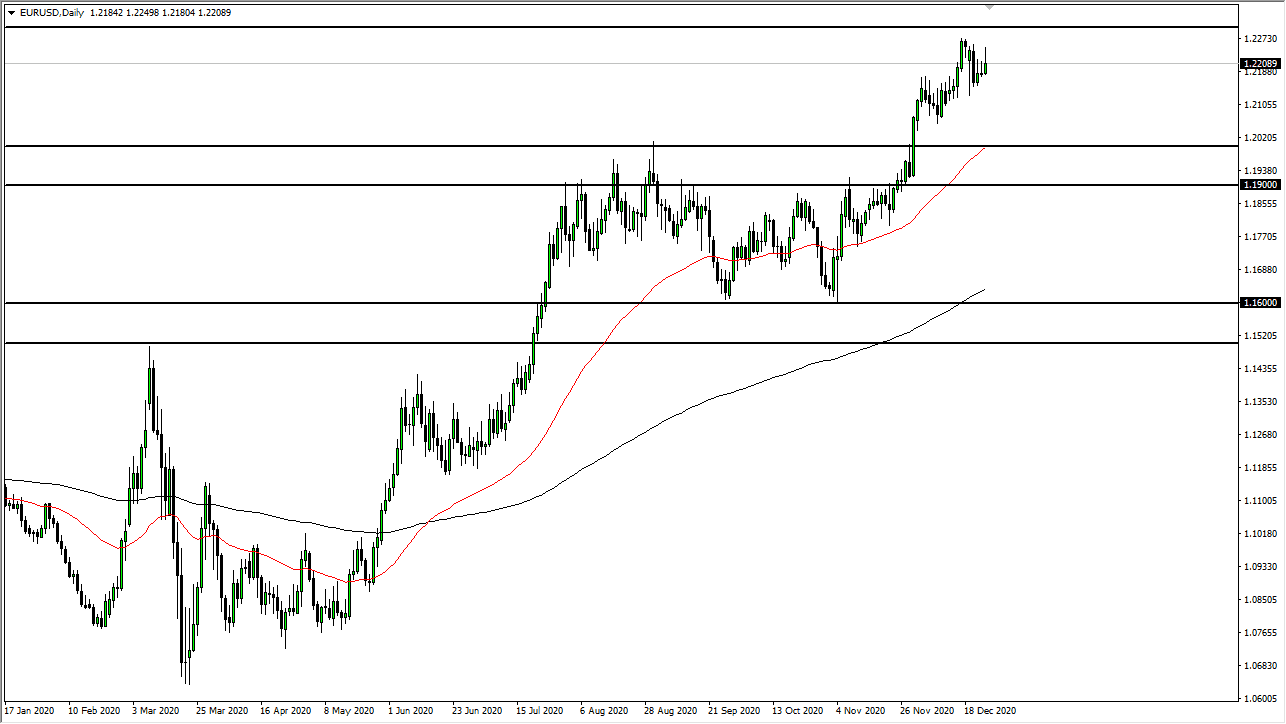

The euro rallied during the trading session on Monday but gave back the gains rather quickly. It looks as if the 1.23 level will continue to be rather resistive, and it is likely that we will continue to see a lot of selling pressure in that area. The 1.23 level extends to the 1.25 level as far as selling pressure and supply is concerned.

Underneath, I like the 1.20 level as a bit of a floor, due to the fact that it extends down to the 1.19 level based upon recent action. The 50-day EMA is sitting at the 1.20 level, which adds even more credence to that level as support. The euro should continue to see a lot of choppy behavior due to the fact that the European Union is trying to lock itself down to stave off coronavirus figures. At the same time, the ECB is almost certainly going to loosen monetary policy, possibly devaluing the euro.

On the other hand, the US dollar will be devalued due to stimulus, so this is going to continue to be a bit of more “currency warfare” as we have seen previously. As central banks around the world try to devalue their currencies, we will continue to see a lot of these noisy behaviors. The month of January will probably be a lot of position starting more than anything else, so we will continue to fluctuate throughout most of the month. The size of the candlestick during Monday suggests that we are going to run into a lot of selling pressure if we try to get too far ahead of ourselves. I do not anticipate a major breakout or breakdown, unless the ECB surprises everyone. I anticipate that we also have a lot of short-term back-and-forth trading with an eye on the 1.2150 level as what could be thought of as “fair value” for the next several weeks. I believe that the market is going to continue to be very erratic and difficult to trade with any significant amount of size. With this, be cautious about your position sizing, and stick the short-term charts in this range.