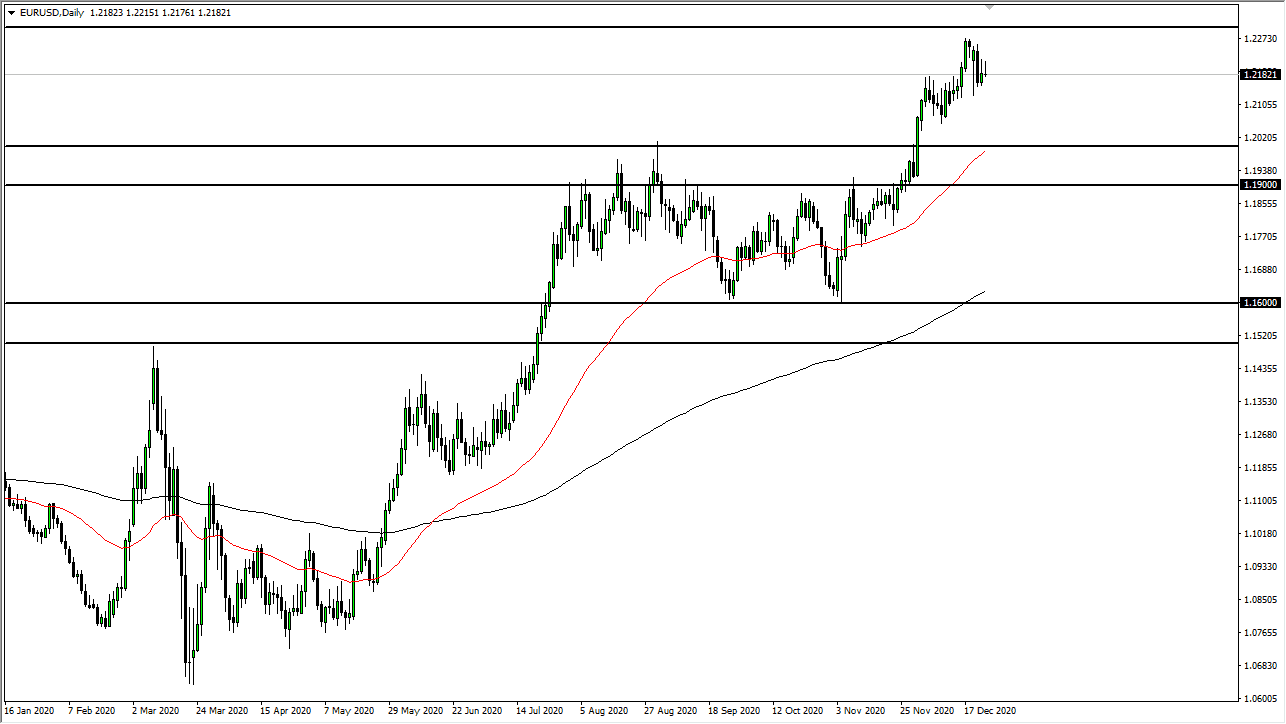

The euro rallied a bit during the trading session on Thursday, to reach towards the 1.22 handle. However, we have broken down from there and ended up forming a shooting star. This followed the shooting star on Wednesday, but it looks like it has a lot less to do with anything at this point other than a lack of liquidity. There are many questions out there whether or not we can continue to go higher, but from a longer-term standpoint, there is a major resistance barrier above that we need to watch.

That barrier is the 1.23 level, an area that I have been talking about as a potential target for some time. I do not necessarily think that we will be able to break above it eventually, but it will probably cause pullback if we get to that area. To the downside, I recognize that the 1.20 level underneath is support that extends down to the 1.19 level. What is even more interesting is that the 50-day EMA is starting to reach towards the 1.20 level, so at this point I do think that that is your support level.

It is interesting that both the euro and the pound fell on the day that the deal was finally signed between the two economies. The market is likely to see a bit more of a negative move in the short term, but I do not think that it is time to start selling the euro. You need to look at this as a range-bound market, with a roughly 300-point field of play. We will likely continue to see a lot of back and forth, so you will have to be very cautious as we head into the new year. Further compounding the issue is the fact that stimulus in the United States seems to be heading out again, so we will have to wait and see how that plays out. At this point, we are essentially right in the middle of what I see as a potential range.