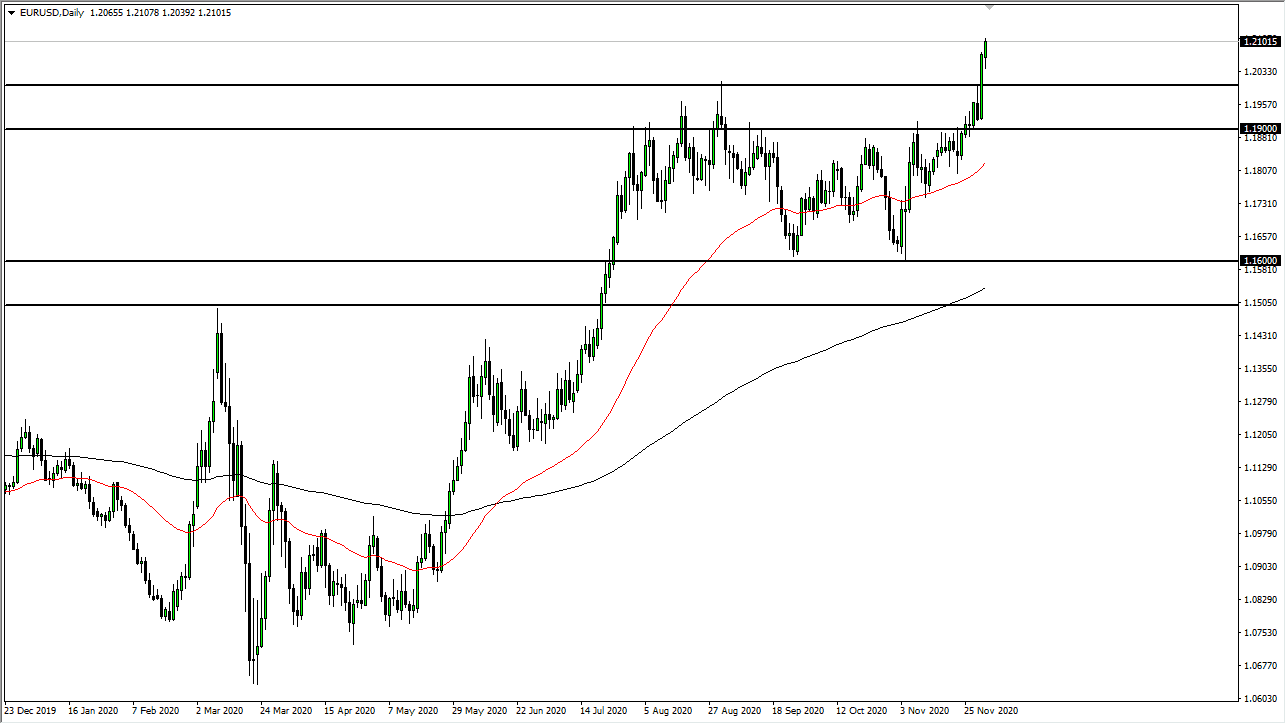

The euro rallied significantly during the trading session on Wednesday, after initially pulling back to digest some of the gains from Tuesday. Tuesday was a major breakout that had big ramifications for the long-term attitude of this pair. The best thing you can do is wait for a short-term pullback in order to take advantage of value in the euro. After all, the US dollar has been absolutely eviscerated, and the euro will be one of the biggest beneficiaries of this.

The market is likely to continue to see upward pressure on pullbacks, and the area between the 1.19 level and the 1.20 level should offer plenty of support, as it was a massive resistance zone. That, compounded with the fact that the coronavirus numbers in the United States are going up while the virus numbers in the European Union are going down, we should see buyers to continue to go higher.

Furthermore, the 50-day EMA is starting to turn to the upside so it should offer support. Right now, the market should continue to see a move to the 1.23 level based upon the measured move, and when you look at the weekly chart, you can see there is a clear area of “dead space” between 1.20 and 1.23 above. I have no interest in trying to short this market, because it is obvious that we have broken out to make a huge difference.

In fact, unless we see a complete 180 when it comes to the direction of the Federal Reserve, I do not see how the euro will fall apart anytime soon. Granted, there will be significant pullbacks occasionally, but it is obvious that the longer-term trend is most certainly turning around to the upside, so we are looking at an opportunity to pick up value occasionally that should be taken. We are a bit stretched right now, but given enough time, the trend should continue. Simply waiting and being patient enough to buy this market on dips should be the best way going forward, unless you are already holding on.