The euro rallied significantly during the trading session on Wednesday, reaching towards the 1.22 level before pulling back a bit. Some of this may have to do with the idea that the holiday season will suck the volume right out of the market, but at the same time, we have many headlines about the Brexit negotiations. It looks like we are getting closer to the end of the negotiations, and certainly the tone has taken on more of a positive note. That has lifted the British pound quite drastically, and even gave a bit of help to the euro. However, you have to keep in mind that if the EUR/GBP pair starts to fall, that will have a knock-on effect over here as well.

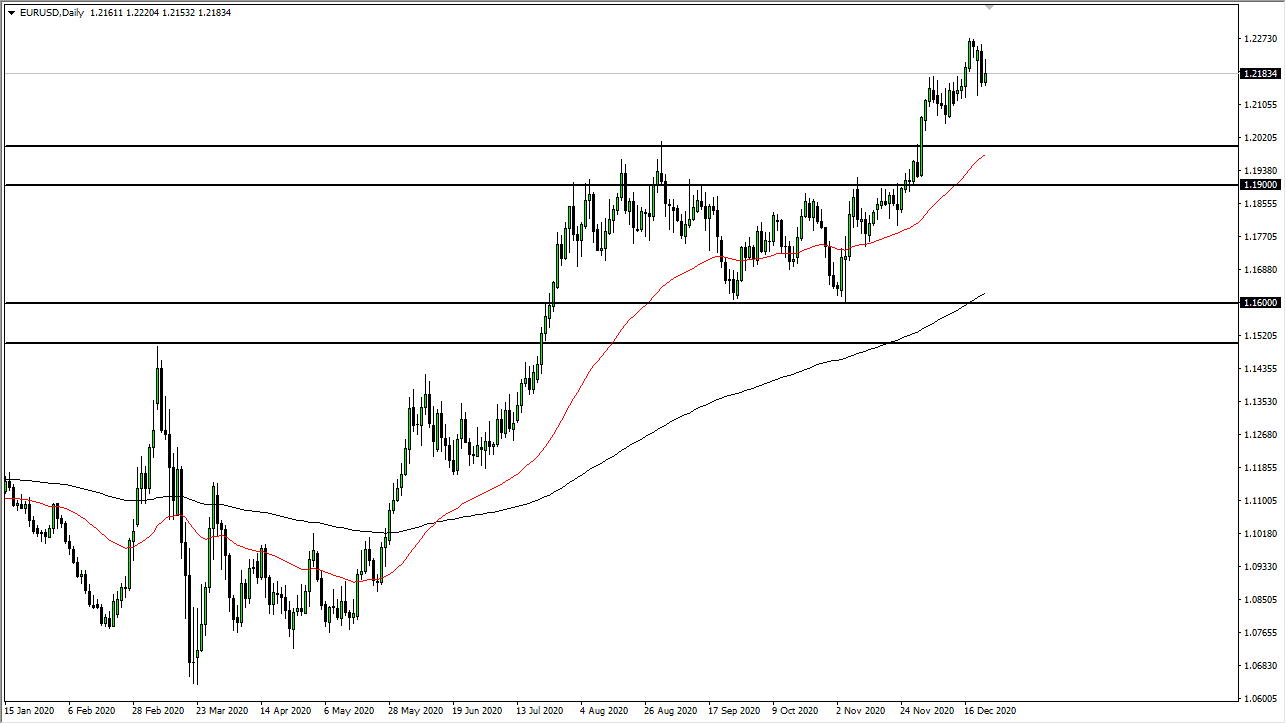

When you look at this chart, you can see that there is a bullish flag that broke from the 1.19 level, which measures for a move to the 1.23 level. That does not necessarily mean that we need to get there overnight, though, so keep in mind that it could take time to get there. But even with the Brexit situation being what it is, there are other reasons to think that this pair will continue to go higher.

The most obvious thing is the stimulus coming out the United States, which has been recently agreed to. However, President Donald Trump has called for even more stimulus coming out, and it looks like it is starting to pick up political support. That means that the US dollar will probably have to lose some value going forward as well. The market fell down to the 1.2150 level, which has a bit of importance attached to it, due to the fact that it is the top of the bullish flag that had formed. I do think that the 1.23 level is an area that could cause a bit of trouble though, so we are most certainly very late in the rally, at least for the time being.

Even though we have stimulus out there working against the US dollar, the reality is that the European Union has a whole mess of problems with coronavirus numbers just as the United States does, so one has to wonder whether or not money will start to run back towards safety in the form of the US Treasury markets anytime soon. If it does, that will cause a pullback in this pair.