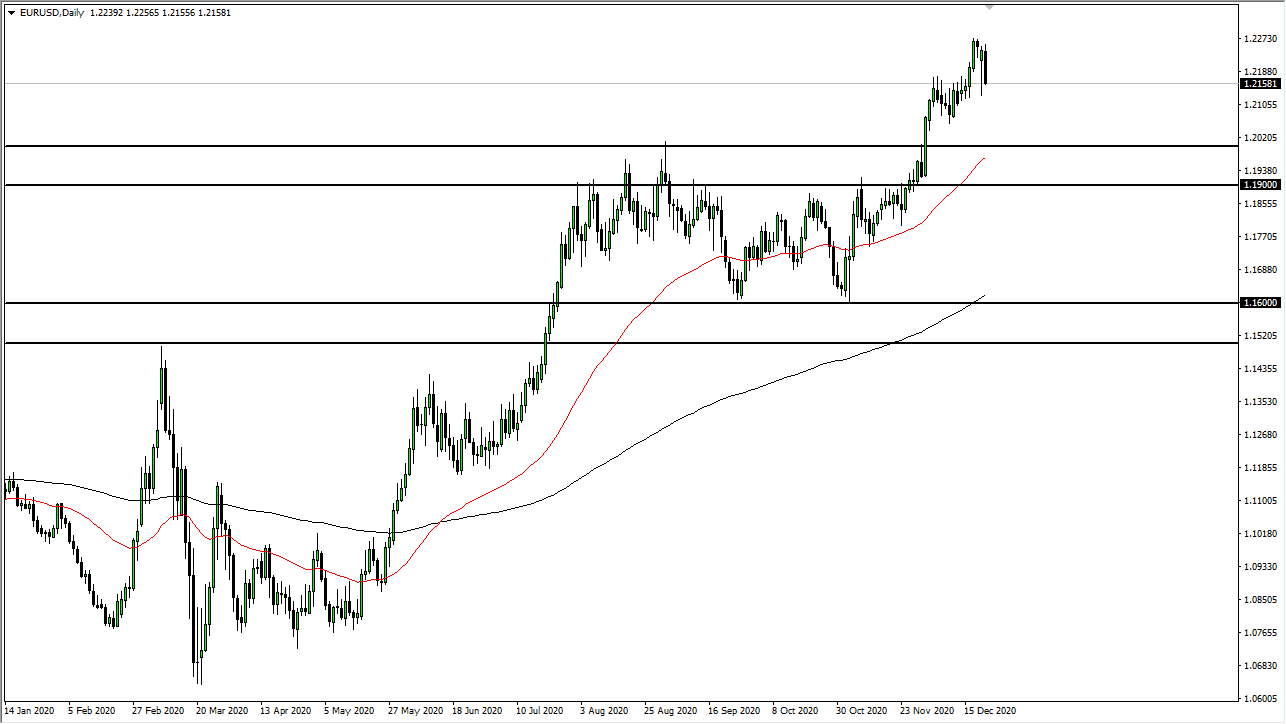

The euro initially tried to rally during the trading session on Tuesday as the Brexit negotiations continue to fail when it comes to a resolution. The 1.2150 level is an area that previously had been resistance, and therefore should be supported at this point. This pullback will end up being a buying opportunity, but the fact that we are closing towards the bottom of the range does not do much to instill confidence in the short term. Beyond that, you have to keep in mind that the liquidity would have been very thin, so the fact that it is the holidays probably aggravates any type of move.

The length of the candlestick is somewhat impressive, especially considering that it is almost as long as the one before it. Remember, the Monday session was wild as there were concerns about the UK lockdown and the coronavirus mutating. The market is likely to run towards the safety of the US dollar to get away from the danger. I still believe that we're in an uptrend, though, despite the fact that we have seen some ugliness over the last 48 hours. The 1.21 level underneath is support as well, as it is the top of the bullish flag signaling that we could be going as high as the 1.23 level over the next several weeks, if not months.

To the downside, even if we break down a bit from here, there is plenty of support near the 1.20 level, extending down to the 1.19 level, which has previously been a huge resistance barrier. The market breaking above there was the point from where we broke out, and now if we pull back, it would be simply retesting the previous resistance barrier in a phenomenon known as “market memory.” The 50-day EMA is starting a resource 1.20 level as well, so that is another reason to think that the buyers would jump back in and push this market to the upside. The lower we go, the more likely we are to see value in the euro, especially with stimulus coming out of the United States, which is likely to be just the beginning of even more financially loose policies coming out of D.C.