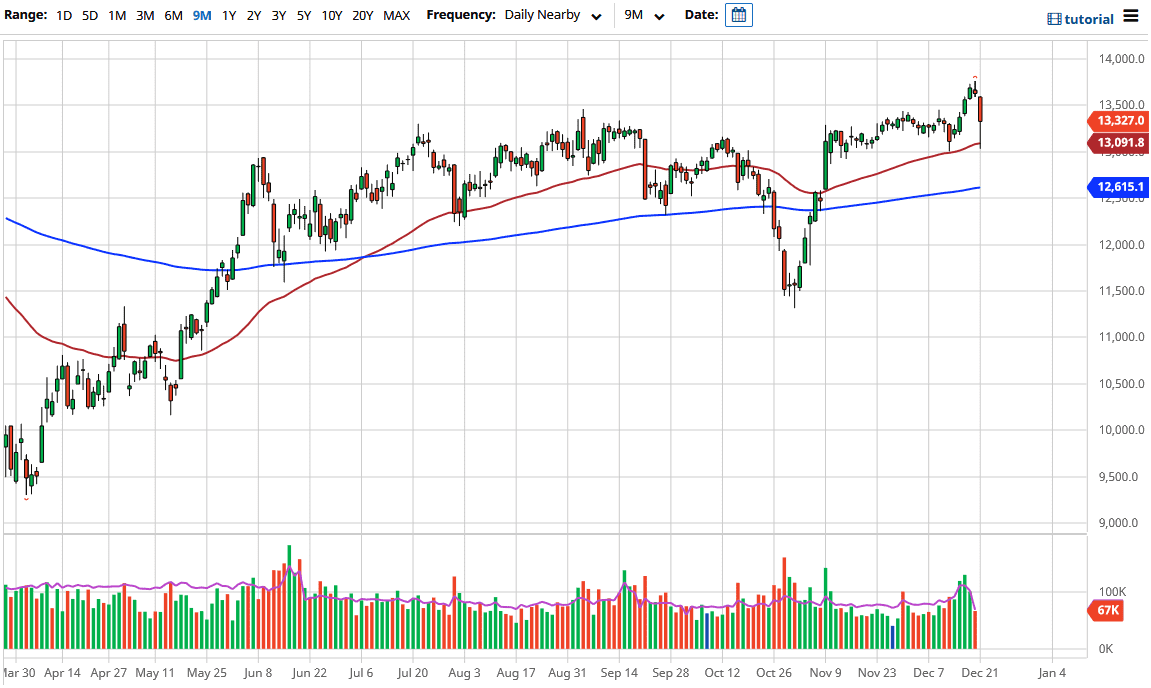

The DAX Index broke down a bit during the trading session on Monday as European traders completely lost it over the coronavirus mutation in the United Kingdom. But by the end of the day, the DAX had recovered quite nicely, not only from a large, round, psychologically significant figure, but also from a significant technical indicator as well. Looking at the candlestick, it looks very much like a hammer, which suggests that there are buyers underneath. What is interesting is that they were at the 13,000 level and the 50-day EMA, both areas that should show - and have shown - signs of support.

Part of the recovery was probably due to the fact that the US dollar gave up some of its gains. Initially, as European nations restricted travel from the United Kingdom, people started to go running towards anything remotely close to safety. The US dollar is one of the quickest vehicles to run towards safety, as people will buy US Treasuries and other US dollar-denominated assets. Beyond that, you also have the fact that people will be getting out of stocks in general, with the DAX no different.

To the upside, I see the 13,750 level as a significant barrier, but eventually I do think that we will break above it. At that point, the DAX will likely go looking towards the 14,000 level, perhaps even higher than that. We are at the end of the year though, and there is a lot of concern when it comes to the idea of liquidity, which could cause many problems. The market then could be very noisy, but we are still very much in an uptrend and there is no point in fighting it. Most traders that are involved in the DAX right now have already placed their trades for 2021 and are willing to ride out the noise. For short-term traders, buying dips probably continues to be the best way going forward, with an eye on the 13,000 level as it should be support. Underneath there, you have to keep an eye out for the 200-day EMA which is currently sitting at the 12,600 level.