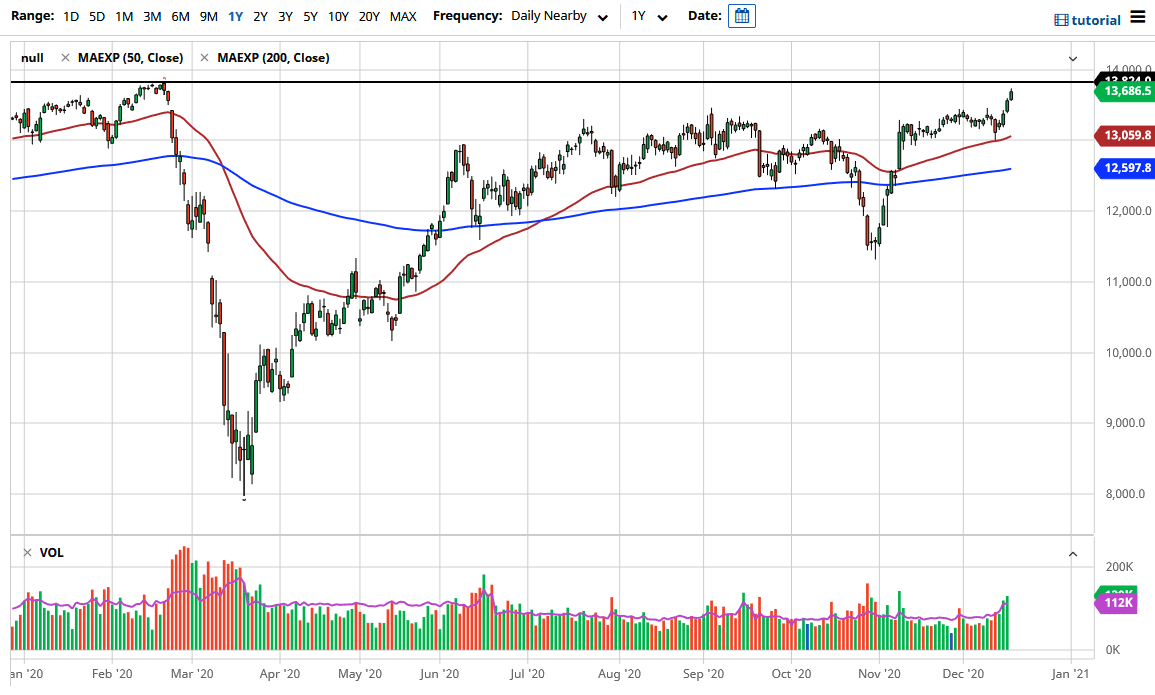

The German index has rallied again for the third day in a row on Thursday, as it looks like we are ready to go higher. That being said though, there is a significant amount of resistance near the €13,825 level, which of course is where we had formed a major high before the pandemic really took hold of Europe and the rest of the Western world. In other words, it looks as if the German stock market is ready to do a complete reversal of all of the negativity.

Remember, markets are supposed to be “forward-looking indicators”, and therefore they are looking for the time frame when vaccines become highly widespread, and markets can look towards more normalized economies. In the short term, Germany is locking itself down in various bits and pieces, and of course cases are starting to spread out yet again. It is a bit of a strange dichotomy, stock markets trying to break into major highs while the real world struggles.

One of the biggest headwinds to the DAX at the moment might be the strengthening Euro, which looks likely to go to the $1.23 level. It is not as if it is extraordinarily expensive, it is just that there is upward pressure on the value of the Euro in general, and as the German index is highly levered to German exports, the currency headwinds can cause a bit of an issue. Nonetheless, the trade weighted Euro is not overly expensive, so it is probably something that DAX traders can live with.

Whether or not we slice through the resistance easily, that is a completely different question, and as we head into the weekend it would not be a huge surprise to see the market pull back just a bit. However, you should see a significant amount of support somewhere near the €13,400 level, so a nice pullback to that area makes quite a bit of sense from a risk aversion heading into the weekend standpoint, and of course the fact that it is not always easy to simply slice through a major high. At this point, I think it is somewhat obvious that there is a €13,000 floor underneath, as the 50 day EMA is just now crossing that level as well. All things being equal, I believe that the DAX continues to be a “buy on the dips market.”