New confirmed infections remain above 20,000 per day, despite a nationwide lockdown, lighter than the first one. The DAX 30 entered a sideways trend inside of its resistance zone following a spike related to vaccine developments. The lack of bullish momentum can spark a profit-taking sell-off.

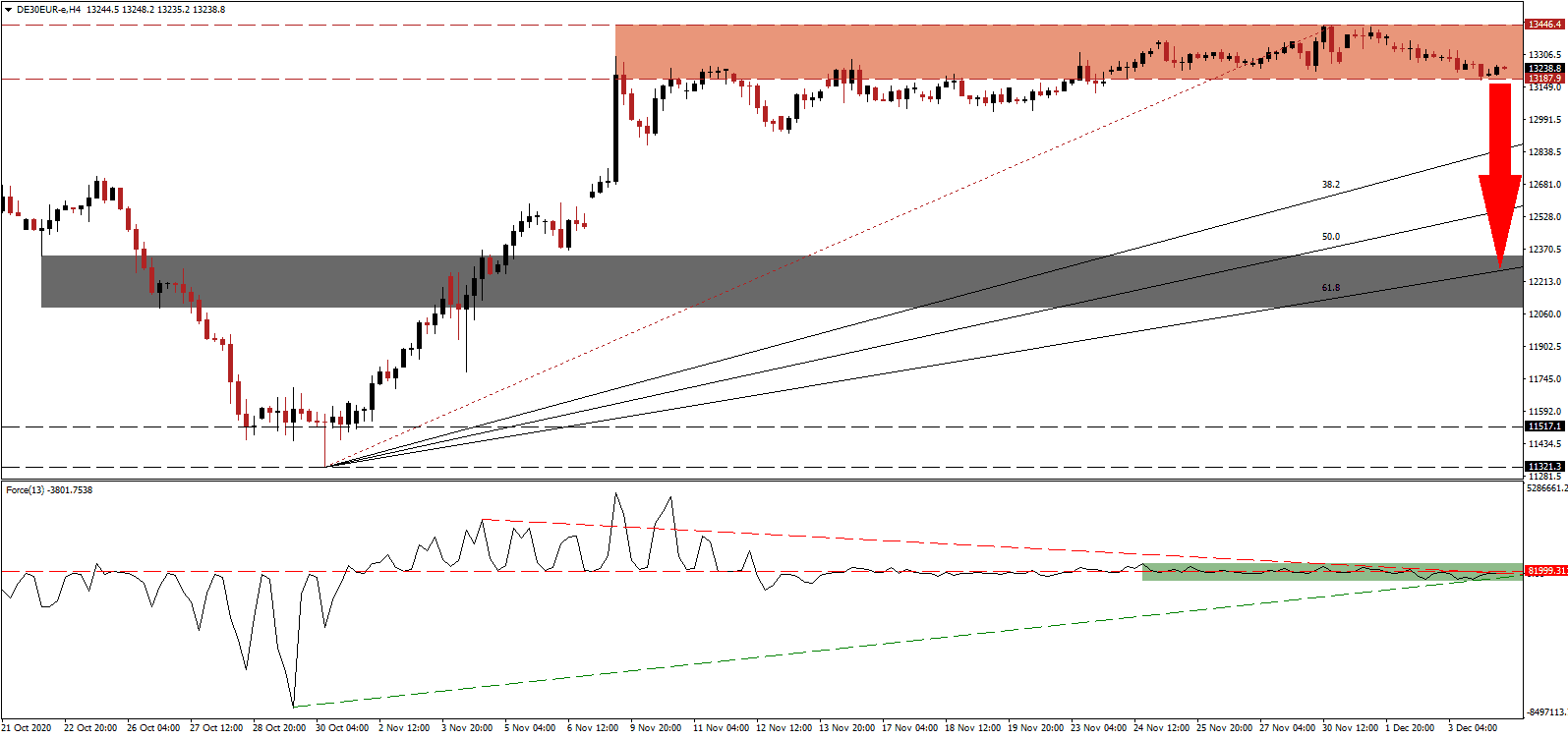

The Force Index, a next-generation technical indicator, flattened out below its horizontal resistance level, as marked by the green rectangle. Adding to breakdown pressures is its descending resistance level, favored to push it below its ascending support level. With this technical indicator below the 0 center-line, bears maintain control over price action in the DAX 30.

Confirming the German economic slowdown is the Weekly Activity Index (WAI), an unofficial high-frequency indicator released by the Bundesbank. While it prints positive data for several weeks, the trend is to the downside. A breakdown in the DAX 30 through its resistance zone located between 13,187.9 and 13,446.4, as marked by the red rectangle, may result in a more aggressive correction.

While the German manufacturing sector displays resilience despite the lockdown, widening the gap to other EU countries, the services sector extended its contraction. Service sector weakness may show in manufacturing with a slight delay. The DAX 30 remains well-positioned to accelerate down into its short-term support zone between 12,087.6 and 12,338.6, as identified by the grey rectangle, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 13,240.0

- Take Profit @ 12,220.0

- Stop Loss @ 13,500.0

- Downside Potential: 10,200 points

- Upside Risk: 2,600 points

- Risk/Reward Ratio: 3.92

A breakout in the Force Index above its descending resistance level can lead the DAX 30 into a temporary price spike. Traders should consider this as a secondary selling opportunity amid a bearish medium-term outlook for global equity markets. The upside potential remains confined to its resistance zone located between 13,735.7 and 13,827.9.

DAX 30 Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 13,650.0

- Take Profit @ 13,820.0

- Stop Loss @ 13,500.0

- Upside Potential: 1,700 points

- Downside Risk: 1,500 points

- Risk/Reward Ratio: 1.13