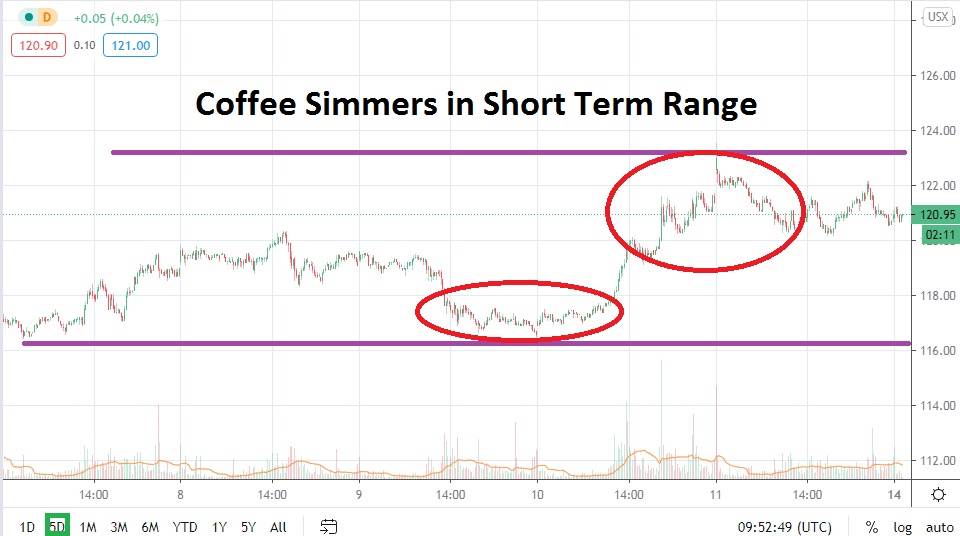

After hitting mid-term price highs in November and sustaining its value going into December, coffee has run into slight headwinds which have produced choppy trading. However, the price of the commodity does continues to traverse within striking distance of important junctures, above which makes an intriguing speculative wager.

As of this morning, coffee is priced below prices seen last week and short-term resistance is near the 122.15 level. If support levels below can prove adequate and form a base for traders to pursue upwards momentum, the 122.15 does look rather vulnerable short term. Yes, speculative conditions will have to include solid demand, but if this juncture is penetrated higher, the 122.50 mark is the next target. Like many commodities, the price of coffee can change quickly, and volatility is a certainty within the market. Speculators always need to manage their risk-taking carefully when trading.

However, if the 122.50 level can be broken higher and the value of coffee remains above this mark in a sustained fashion, the commodity could be ready to test higher values sooner rather than later. The 124.50 to 124.70 level proved very strong as resistance in November and it is this value that speculators who have bullish sentiment may be contemplating.

Support for coffee is near the 120.55 mark, which is very close to the current price of the commodity. If this value proves adequate and upside momentum is found short term, it could spark additional buying within the commodity. Support near the 119.55 is also below, and if tested and broken lower, it could be a bad indicator against bullish momentum. However, speculators may want to consider buying coffee on slight pullbacks with limit orders in place to look for reversals upwards.

A one-month price band of 115.90 to 124.70 exists within coffee. The commodity has been able to sustain its recent gains, but resistance has proven difficult to penetrate higher. However, after two failed attempts to break through resistance in November and headwinds which have effectively tamed the price of coffee short term, the commodity remains near better mid-term values and may be able to eventually challenge higher values. Remaining a speculative buyer in coffee appears to be a logical endeavor.

Coffee Short-Term Outlook:

- Current Resistance: 122.15

- Current Support: 120.55

- High Target: 123.50

- Low Target: 119.55