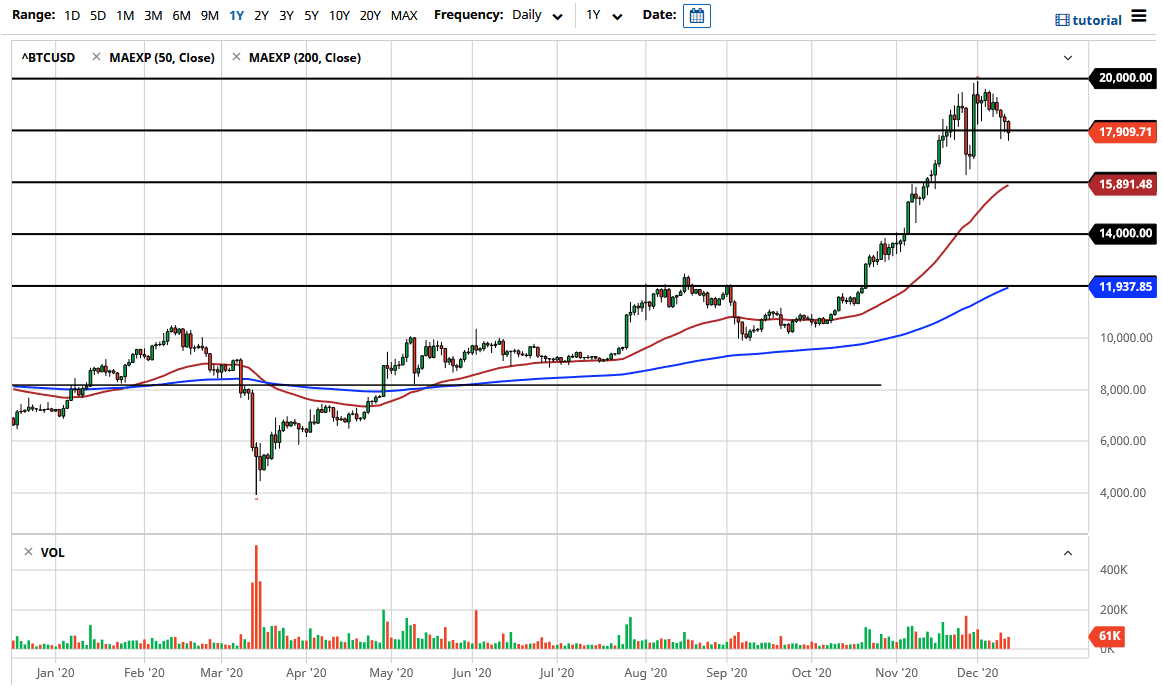

The Bitcoin market fell again during the trading session on Friday as we have seen a bit of a boost in the US dollar. This works against the value of Bitcoin as it is priced in those very dollars. Furthermore, it is a way to get away from fiat currency, so the negative correlation should continue. The $18,000 level was pierced during the trading session, and we have made a “lower low” during the day. This is likely to open up the market to a move even lower, but again, I will reiterate here: I am not looking for a selling opportunity; rather, I would suspect that Bitcoin traders will be looking for an opportunity to buy it at lower levels.

The 50-day EMA sits at roughly $16,000, so many people will be interested in buying in that general vicinity. Like I have said previously, we may have gotten ahead of ourselves for a while, so it does make sense that we need to grind sideways or even pull back in order to digest some of the massive gains. After all, markets cannot go straight up in the air forever and, ironically, Bitcoin traders will have to be conscious of what is going on with stimulus talks in the United States. As the US dollar is going to be sensitive to stimulus and of course the size of the stimulus, it will have a correlation to the market in Bitcoin.

Looking at this chart, even if we break down below the $16,000 level, I do not think that it is going to be market that sellers will jump into; rather, a lot of profit-taking will probably come into the mix. The market tends to move in $2000 increments, so keep that in mind. It needs to pull back or at least build up some time and pressure before you can break above the $20,000 level, which is not a huge surprise considering that it was an all-time high that caused absolute chaos just a few years ago, on which a lot of the retail public got absolutely smoked. Those scars are still rather strong, and one would have to think there is a certain amount of psychology going on in the markets right now.