Today's AUD/USD signal:

Risk 0.55%.

Buying trade was activated on Thursday's signals, made a slight profit and has not yet closed.

The buy pending the signal for the day will be canceled if the price reaches the target before activating the trade.

Long trade ideas

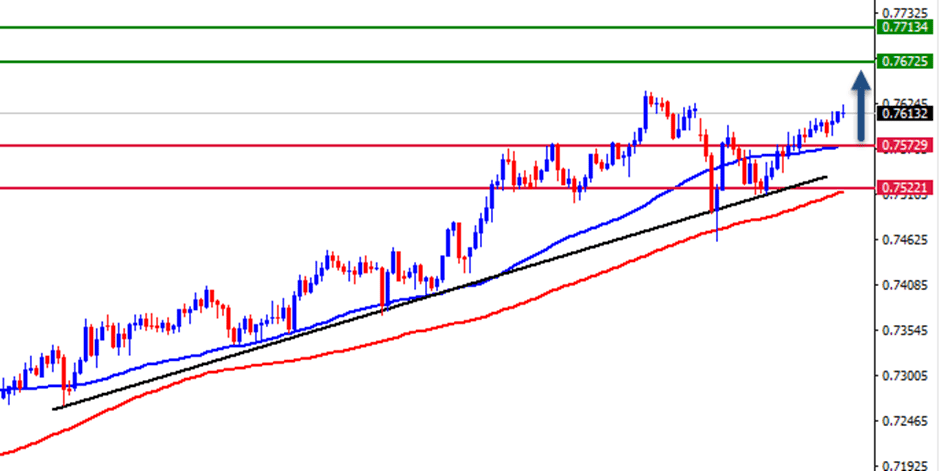

Long entry on a pending order from 0.7572 levels.

Place your stop loss 1 pip below the support levels 0.7521.

Move the stop loss to the entry area and continue with the price moving by 25 pips in profit.

Remove 50% of the position as profit when the price reaches 30 pips, and leave the remaining position until reaching the strong resistance levels at 0.7672.

Short entry ideas

Short entry from below 0.7510 levels on the four-hour time frame.

Place your stop loss above 0.7530 levels.

Move the stop loss to the entry area and continue price moving by 25 pips in profit.

Remove 50% of the position as profit when the price reaches 35 pips, and leave the remaining position until reaching the strong resistance levels at 0.7450.

AUD/USD Analysis:

The Australian dollar keeps rising against the US dollar with the reopening of weekly trading, approaching the target of last Thursday's signal. However, the pair is rising slowly amid the lack of strong data in addition to the Christmas holidays, which made the pair's rise weak with declining liquidity and slowing momentum.

The US dollar weakened against major currencies after US President Donald Trump approved a bill for the US stimulus package that Congress passed during the beginning of last week to help counter the repercussions of the coronavirus.

Trump had previously refused to sign the bill the past week, amid his opposition to some provisions of the volume of aid, demanding that it should be modified to 2000 dollars instead of only 600.

Technically, the AUD/USD pair continues to rise, maintaining the general bullish trend. The pair is currently trading at 0.7611 levels above strong support levels at 0.7570 and 0.7522 and above a trend line, in addition to the 50-day and 100-day moving averages on the four-hour timeframe.

In light of this general trend, I am not inclined to the idea of selling, but rather to wait with each downward correction to re-buy again. Entries are from the levels specified in the signal, bearing in mind that the currency market in general has a large decline in liquidity with a significant decline in momentum in light of the withdrawal of traders before the holidays. It is therefore desirable that your trading strategy and risk management be adjusted accordingly.