Today’s AUD/USD Signal

Risk 0.55%.

The pair rose as expected in yesterday’s signal from the buying point, though it didn’t reach the goal yet.

Best Buying Entries:

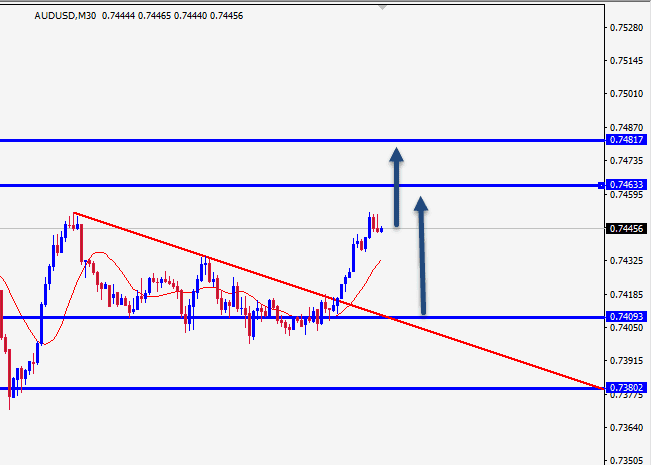

Long pending entry from the 0.7409 support level on the 30 minutes timeframe.

Put the stop loss below the 0.7380 support.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7463

Best Selling Entries:

Short entry below the 0.7378 level on the hourly timeframe.

Put the stop loss above the 0.7410 level.

Move the stop loss to entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7330 support.

AUD/USD Analysis

The AUD/USD pair rose at the beginning of the day's trading following optimistic data.

A report from Reuters was published saying that survey data from Westpac on Wednesday indicated that Australian consumer confidence reached its highest level in a decade in November after easing measures to control COVID-19. The report also contained data expected from the Australian Central Bank during the beginning of the new year, including the bank’s announcement to reduce unemployment expectations and raise growth expectations.

The Westpac-Melbourne Institute Consumer Confidence Index rose 4.1 percent to 112 in December from 107.7 in November. This was the highest reading since October 2010.

Though the AUD/USD is trading in a general bullish trend, the pair recently started losing bullish momentum as it is currently trading at the 0.7444 level above strong support levels concentrated at 0.7409 and 0.7380 levels, respectively, on the 30-minute time frame.

We expect the pair to continue rising from the current levels or from the strong support levels mentioned in the recommendation, with targets reaching 0.7480, bearing in mind that the recommendation is no longer valid if the target is reached before the buy order is activated.