Today’s AUD/USD Signal

Risk 0.55%.

The AUD/USD rose yesterday as per the long trade, and achieved gains by moving the stop loss point.

Today’s long signal should be cancelled in case the price reached the target before activation.

Best Buying Entries:

Long pending entry from the 0.7556 and 0.7546 support levels.

Put the stop loss below the 0.7428 support.

Move the stop loss to the entry point and continue profit with a 25 pips price movement.

Close half the contracts when the trade is 35 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7502.

Best Selling Entries:

Short entry below the 0.7503 resistance level on the 4-hour timeframe.

Put the stop loss above the 0.7515 level.

Move the stop loss to the entry point and continue profit with a 25 pips price movement.

Close half the contracts when the trade is 35 pips in profit and leave the remainder of the contracts to run until the 0.7458 support.

AUD/USD Analysis

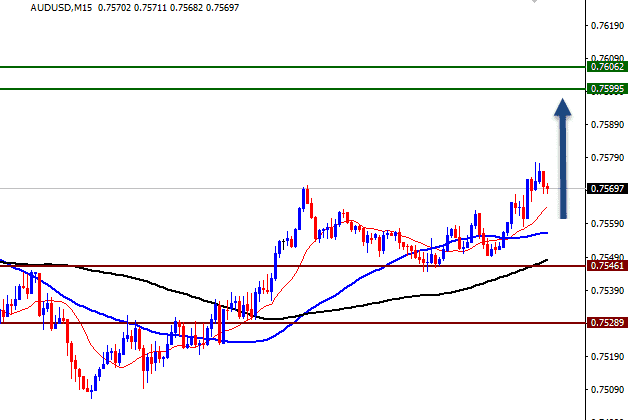

The AUD/USD continues to rise in a general bullish trend.

In key news, reports from Westpac showed that the central bank will introduce a second A$100 billion program after the first program expires in late April/early May.

The AUD/USD is trading in a general bullish trend, as the pair is currently trading the 0.7570 level above the 50-day moving average, which has crossed bullishly with the 100-day moving average on the 30-minute time frame. The liquidity flow indicator also witnessed some variation. The index tends to decline, indicating the flow of liquidity in the direction of buying the US dollar temporarily. The general trend of the pair is upward, so any correctional trend is a good buying opportunity.

We expect that the pair may witness some correction from the current price by reaching the support points mentioned in the signals, with the possibility of resuming the purchase with the pair reaching the strong support area located between 0.7546 and 0.7530.