Today’s AUD/USD Signal

Risk 0.55%.

The AUS/USD rose to it’s highest level in more than 2 years.

Yesterday’s deal was not reached and was cancelled after the price reached the goal.

Best Buying Entries:

Long pending entry from the 0.7453 support level on the H1 timeframe.

Cancel the signal if the pair reaches the goal before activating the signal.

Put the stop loss below the 0.7400 support.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7500.

Best Selling Entries:

Short entry below the 0.7390 level on the hourly timeframe.

Put the stop loss above the 0.7420 level.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7330 support.

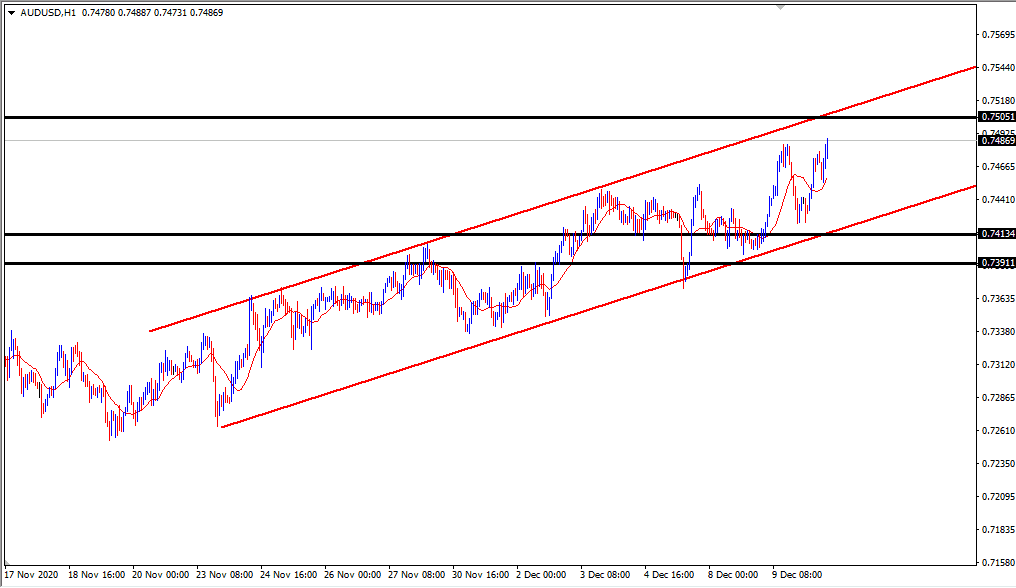

AUD/USD Analysis

The AUD/USD continued to rise during early trading today, as analysts in international banks attributed the strength of the Australian dollar to the Reserve Bank of Australia's policy to reduce the interest rate, which is currently close to zero. A number of other factors also contributed to the AUD's strength, the most prominent of which is the rise in the prices of some commodities, including iron ore. The metal broke record levels during the year after strong demand, especially from China, Australia's major industrial neighbour of Australia.

The AUD/USD pair continued in a general bullish trend, as the pair is currently trading within a bullish price channel at the 0.7482 level above strong support levels concentrated at 0.7459 and 0.7430 levels on the 30-minute time frame. Each bearish wave is considered a good buying opportunity, especially with a test of the strong support level at 0.7414.

We expect the pair to continue rising from current levels or from the strong support levels mentioned in the recommendation with targets up to 0.7500.