Today’s AUD/USD Signal

Risk 0.75%.

Positive comments from Australian Central Bank’s chairman increases risk appetite.

No major change to yesterday’s activated signal, which didn’t reach the goal yet.

Best Buying Entries:

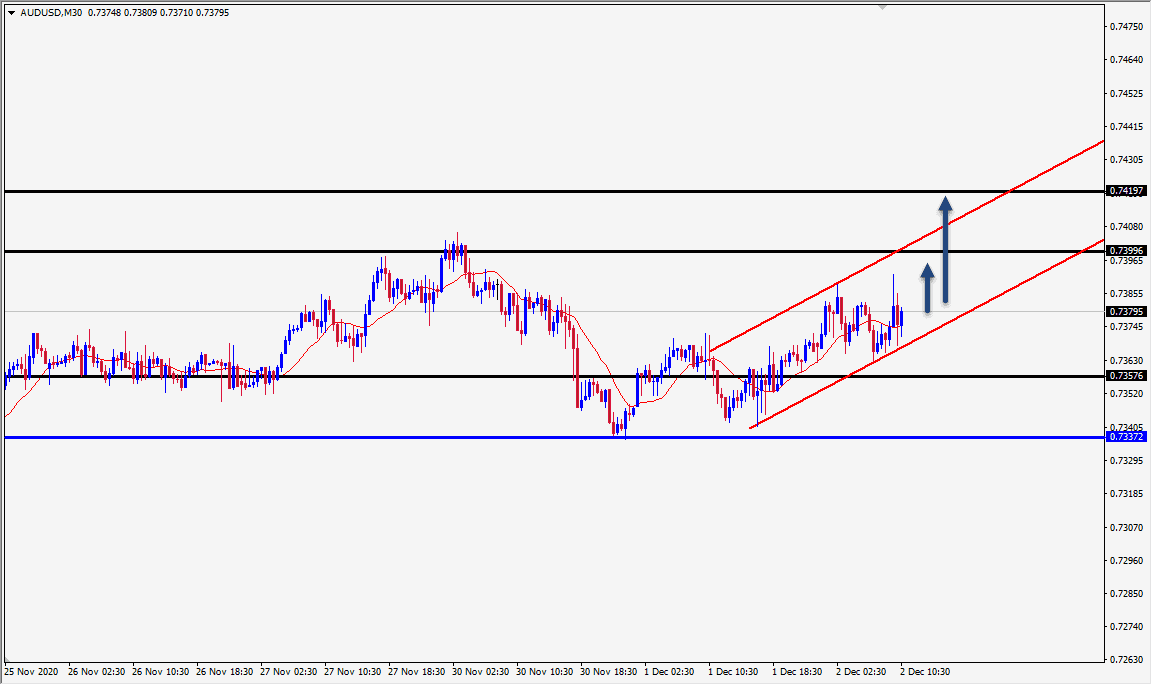

Long entry from current levels or better levels until the 0.7357 support on the hourly timeframe.

Put the stop loss below the 0.7325 support.

Move the stop loss to entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7399 and 0.7419, respectively.

Best Selling Entries:

Short entry below the 0.7320 level on the hourly timeframe.

Put the stop loss above the 0.7340 level.

Move the stop loss to entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7280 support.

AUD/USD Analysis

The AUD/USD went up at the beginning of trading today, following comments by the Australian Central Bank's Governor after a day of fixing interest rates, in which he said he expected strong economic growth.

Reserve Bank of Australia Governor Philip Lowe, speaking to the Australian Parliament's Standing Committee on Economics, said he expects strong positive economic growth in the last two quarters of the year, despite the likelihood of the asymmetric recovery continuing.

In addition, Lowe said there is a high degree of uncertainty about the pace at which the economy will recover amid the pandemic, but it is extraordinarily unlikely for the board to set target nominal interest rates at a negative value.

He added that the central bank is prepared to do more if needed in order to achieve the yield curve target, and that tackling the high unemployment rate is the current priority of the RBA.

On a technical level, the AUD/USD pair is trading within a bullish channel in a general bullish trend on the medium term. The pair is trading at the 0.7379 level at the time of writing. We expect the pair to continue rising from current levels as long as the price stabilizes above the strong support level at 0.7357.

A long trade should be from the current price or from whenever the price approaches the support level mentioned above, but if the pair reverses the trend and breaks all the support lines, then you can enter short trades after retesting 0.7320.