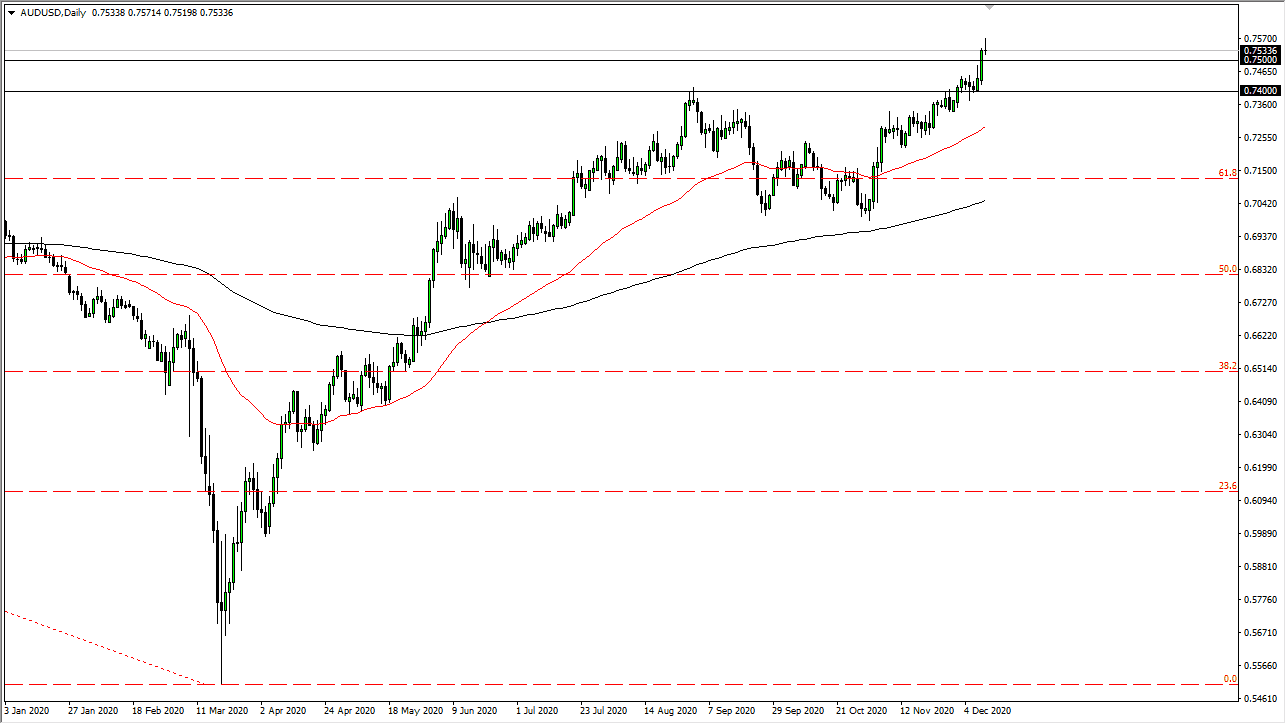

The Australian dollar initially shot higher during the trading session on Friday as we continue to see a move to the upside. However, we gave back the gains later in the day to form a shooting star, which suggests a bit of negativity. This makes sense, because we just broke out to the upside and a major resistance barrier in the form of the 0.75 handle.

Expect that the market will pull back to find buyers again and go looking towards a significant entry point underneath, somewhere between the 0.75 level and the 0.74 level. This market continues to see a lot of inflow due because people are banking on stimulus; perhaps the stalled talks in Congress are part of what is exacerbating the pullback.With the tension that is so prevalent in the political class in the United States, it is not a huge surprise that we would see problems negotiating. Beyond that, we have a runoff election in Georgia to determine the outcome of the Senate races, which causes some issues.

The market is likely to see a lot of volatility due to the latest headlines, but at the end of the day there will be stimulus. Once we get a stimulus package, the Australian dollar will probably continue to go higher due to the fact that the US dollar is falling. Stimulus should dilute the value of the greenback, and that should continue to push us higher. Furthermore, the reflation trade would come back into vogue, meaning that people would be buying commodities, which can lift the Aussie dollar higher. We will be looking to buy dips, so the next day or two could be a bit of a drift lower, but that should only offer value. I have no interest in trying to short the Aussie dollar anymore, as it has proven itself multiple times to be resilient and the greenback has found itself on its back foot against most currencies. With that, this is a significant “anti-US dollar” trade more than anything else.