The Australian dollar rallied during the trading session again on Tuesday, as we are likely to continue seeing a move to the upside over the long term. After all, the United States is cranking up the stimulus, so it should continue to devalue the US dollar. What makes this even more explosive is the fact that it tends to put money towards the commodity space in general, which has a massive influence on the Australian economy. With so many different commodities being produced in Australia, it does make sense that traders will continue to use the Aussie as a proxy for not only stimulus by selling the greenback, but as a proxy for buying things like gold, copper, and the like.

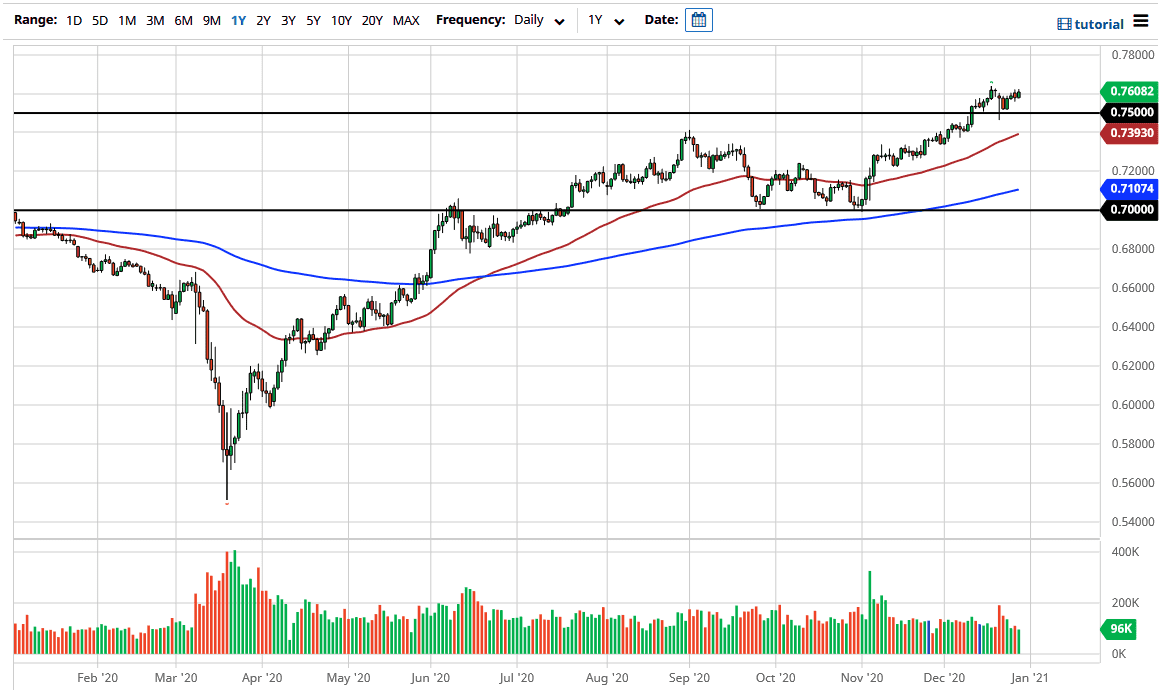

We had recently cleared the 0.75 level which is a large, round, psychologically significant figure, so I think traders will continue to try to push this pair higher. The 0.76 level has offered a little bit of resistance, but at the end of the day it is not as important. Part of the reason this market has not been able to take off to the upside quite yet is simply the time of year. A lot of the volume is lacking, and this pair will not be any different than many of the other then markets at the moment.

Looking underneath, I can make an argument for a significant amount of support not only at the 0.75 level, but possibly all the way down to at least the 0.74 level. That is an area in which we have seen quite a bit of noise in general, and the 50-day EMA is trying to break through right now. When you look at recent trading, we are essentially in a nice ascending channel, which is relatively well-defined. There is no reason to think that this will change anytime soon, so unless something fundamentally happens that is going to throw markets into a tirade, I believe that this will continue to be a “buy on the dips” type of situation. The Australian dollar looks as if it wants to go to the 0.7750 level, and then possibly the 0.80 level sometime in the next few months. I remain bullish at this moment and have no interest in shorting.