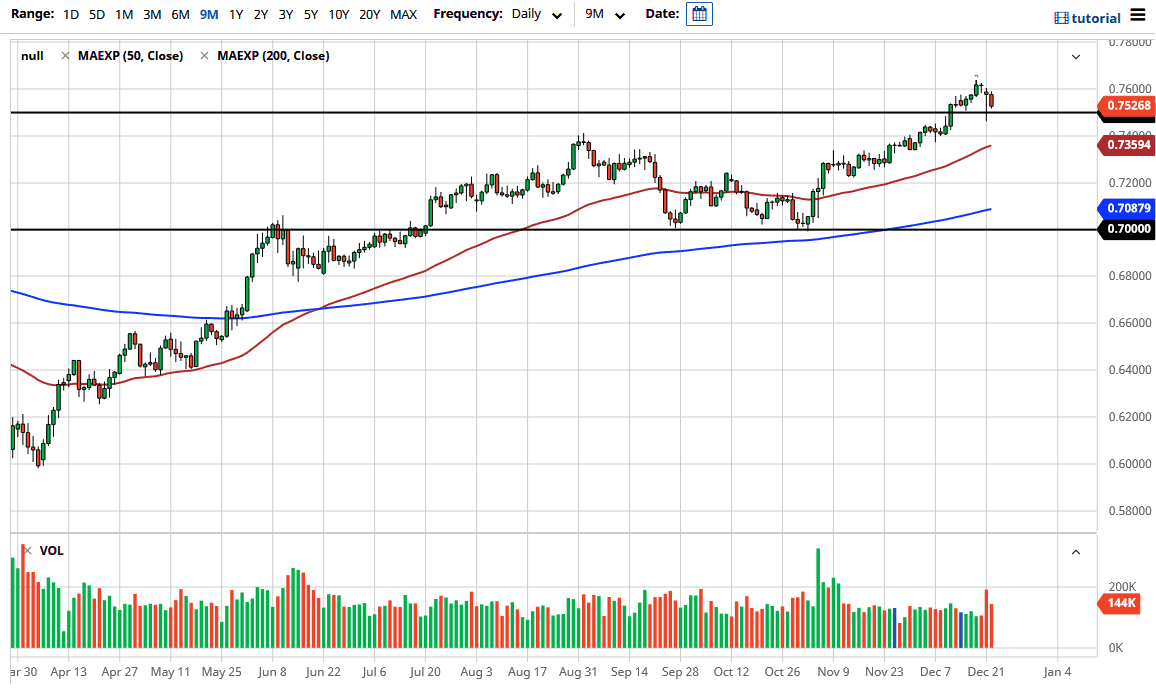

The Australian dollar fell during the trading session on Tuesday in what would have been very thin trading. We are sitting just above the 0.75 handle, which is a large, round, psychologically significant figure. Furthermore, we did up forming a hammer during the trading session on Tuesday when we had pierced that level, only to turn around and show signs of life again. The Americans have just passed stimulus, so the US dollar has been losing strength.

The 50-day EMA sits underneath the 0.7360 level and is racing towards the 0.75 handle that seems to be so important. It is only a matter of time before the markets come back in and try to pick this market up, due to the fact that the Aussie dollar is so highly levered to the commodities markets. After all, as the US dollar lose strength, it makes commodities go higher in value as those commodities are priced in those very same US dollars.

At this point, the market looks as if it will go looking towards the 0.7750 level, possibly even the 0.80 level after that. Short-term pullbacks should continue to be buying opportunities, though, and the longer-term uptrend continues to be very much intact. As long as we can stay above that hammer from the Monday session, the technical analysis does suggest that we will go higher.

This does not necessarily mean that the market is going to shoot straight up in the air, but it certainly has a longer-term bias to the upside. In the short term, we look likely to see a lot of grinding back and forth in order to build up the necessary momentum to continue going higher. The 50-day EMA underneath would need to be broken for me to be concerned about the Aussie, and you should also think that the market may need to simply grind away in order to digest some of the gains, so these pullbacks should be thought of as an opportunity over the next several weeks in a low-volume environment. You should also keep your position size relatively small because you could see the occasional erratic fill.