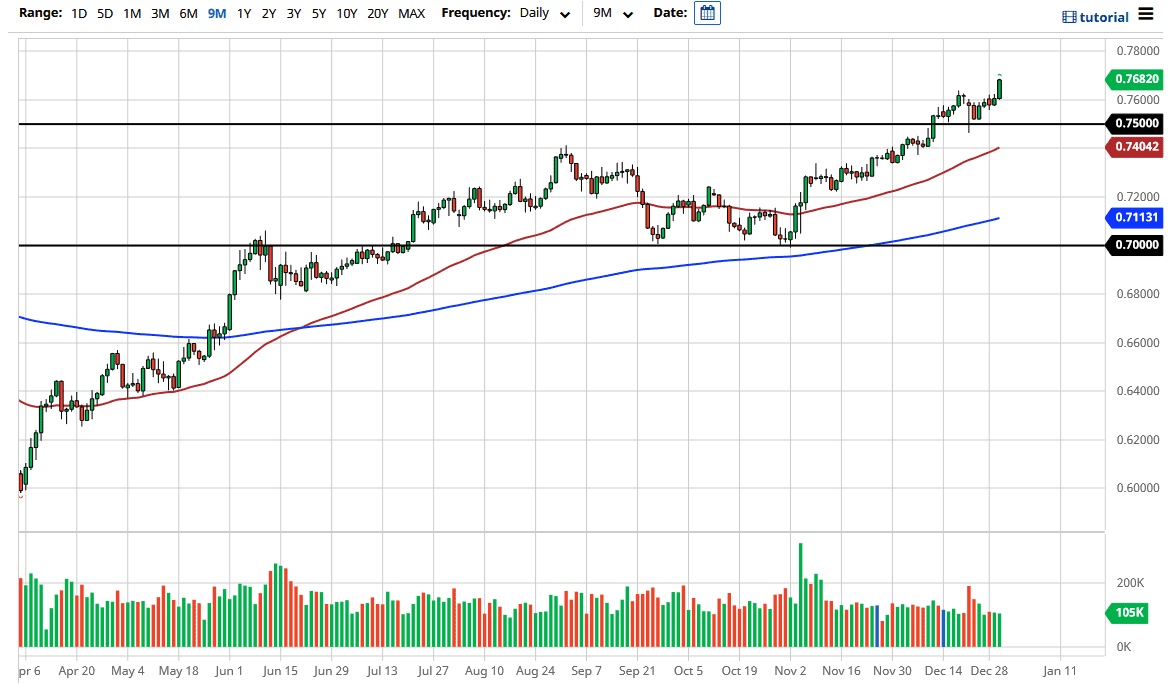

The Australian dollar broke higher during the trading session on Wednesday as we continue to see strength in the Aussie overall. The US dollar is getting hammered due to stimulus, and it suggests that we are going to continue to go even higher. The stimulus package being signed in the United States should continue to devalue the greenback, and that is one of the main drivers of this pair. The fact that we are closing towards the top of the candlestick suggests to me that we are going to see a bit of follow-through.

To the downside, I see the 0.75 level as a major support, as it is a large, round, psychologically significant figure, and an area in which we have seen buyers underneath as well as support. The 50-day EMA is currently breaking above the 0.74 level, so I think there is about a 100-pip range of support in that general vicinity. Dips continue to offer a lot of value, especially as the stimulus coming out the United States should drive up demand for commodities in general, to which the Australian dollar is highly levered.

To the upside, the market will go looking towards the 0.7750 level, which looks like resistance on longer-term charts. Beyond that, I see massive resistance and interest at the 0.80 level, which is your target over the longer term. Over the next several months, I anticipate that the Australian dollar will continue to try to build up a bit of momentum, and certainly will look to the upside. I have no interest in trying to short this pair, at least not until we break down below the 0.74 level, and even at that point there should be supportive areas underneath. The 200-day EMA is sitting at roughly the 0.71 handle, and that being broken to the downside might be reason enough to think about shorting, but it would take some type of disastrous problem in the markets when it comes to risk appetite. I simply do not see that now that stimulus is being unleashed everywhere.