Because of this, it shows that there is a serious lack of demand in the crude oil markets, which should not be a huge surprise. Furthermore, crude oil is likely to be very threatened due to the fact that coronavirus numbers are starting to pick up again, and several countries around the world are starting to shut themselves down, possibly even in the United States going forward.

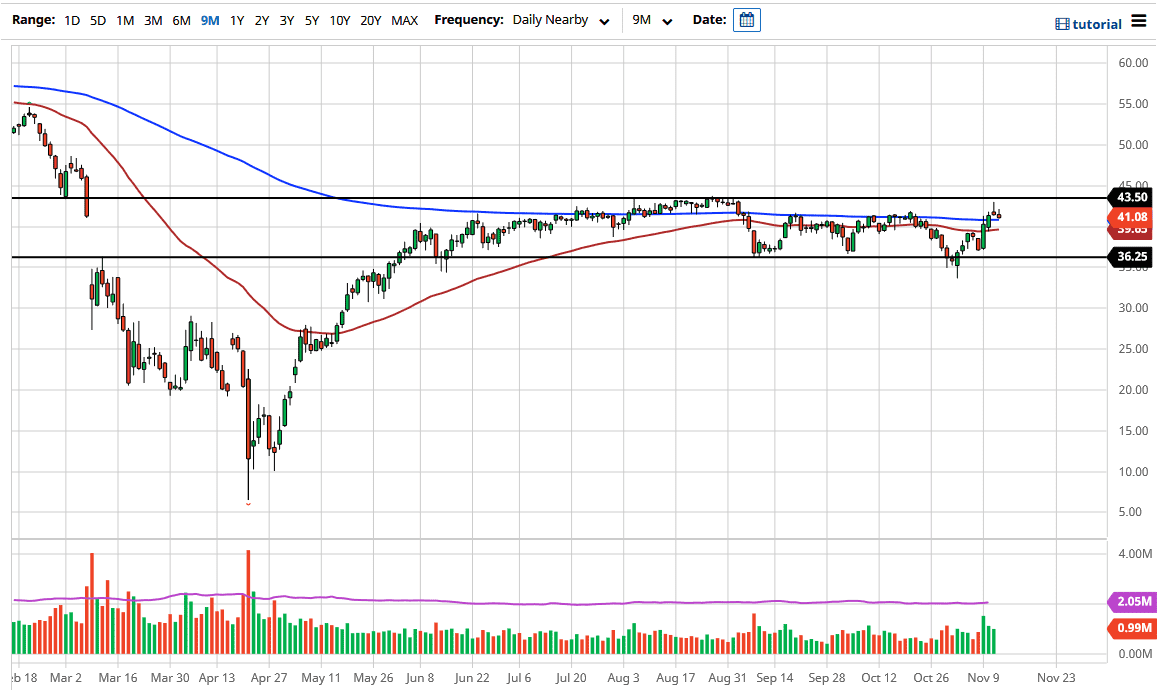

That being the case, the demand for crude oil simply is not going to be there. Beyond that, the supply of crude oil continues to be very stringent as well, so I think at this point in time it is likely that we will go back towards the bottom of the overall range, closer to the $37 level.

Looking at this chart, you can see that we simply have not had the momentum to go anywhere and the idea that a vaccine was suddenly going to change everything for a longer-term move should be laughed at because we had oversupply issues before the pandemic cannot. Beyond that, it is not as if the vaccines going to show up tomorrow then suddenly the demand for crude oil is going to spike through the ceiling. There are more than enough producers out there that will start to pump more oil if price goes higher. Because of this, the crude oil markets are not going to behave as they had in the several previous years. The fact that OPEC is trying to do production cuts but failing also does not help the situation either.

At this point, we have had a nice rally that a lot of people have been willing to sell into. On the other hand, if we were to turn around and break above the top of the $43.50 level, then you could start to take a look at possibly buying, but at this point in time the move above there seems very unlikely. Because of this, I am looking to fade short-term rallies and I do think that selling opportunity should be taken advantage of. This will be especially true if the US dollar starts to pick up momentum as well.