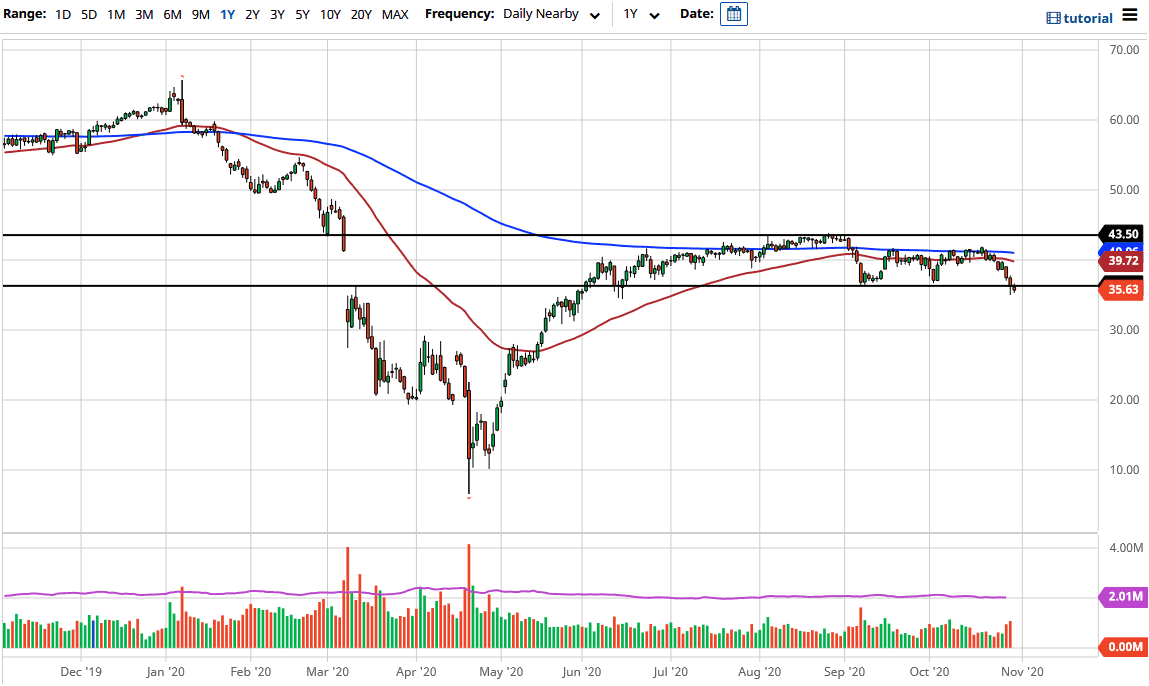

The oil markets fell hard during the trading session on Friday, as we have broken down below the $36.25 level in the West Texas Intermediate Crude Oil market. This is a market that is going to continue to fall since we have almost nothing in the way of demand. After all, the US dollar seems to be strengthening and that works against the value of crude oil in general. The crude oil markets are priced in that currency, so if the market has to deal with a stronger dollar, it is going to take less of those dollars to buy it.

Furthermore, we have the European Union locking itself down, which will have negative connotations when it comes to demand. It is therefore likely that the crude oil market will continue to drop. If we can break down below the bottom of the candlestick from the Thursday session, it is likely that we will be looking towards the $32.50 level, then possibly the $30 level after that. Otherwise, if we do rally, then I think it is only a matter of time before sellers will jump back in and show signs of exhaustion near the 50 day EMA. The $40 level will be a large, round, psychologically significant figure that people are going to pay attention to, so it makes perfect sense that we would see sellers in that area. In signs of exhaustion, I would be quick to start fading, and therefore it is likely that the market would offer even more value from the short side in that region.

Looking at this chart, I do think that it is a simple “fade the rallies” type of scenario; looking at short-term charts in order to fade signs of exhaustion. I believe the market is going to continue to see negativity, not only from the currency headwinds, but from the fact that the European Union is stepping out of the global economy for the most part. We are starting to see other countries around the world talk about the same kind of clampdown, which will almost certainly lead to some type of recession yet again. In a market that has been oversupplied for some time, this is a miserable time to be long of oil.