The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Monday, but gave back the early gains to continue to show lack of momentum. By doing so, it looks like the initial reaction to the virus news will continue to be faded, as it was a massive overreaction. The market gave up gains towards the end of the day, losing over $0.60.

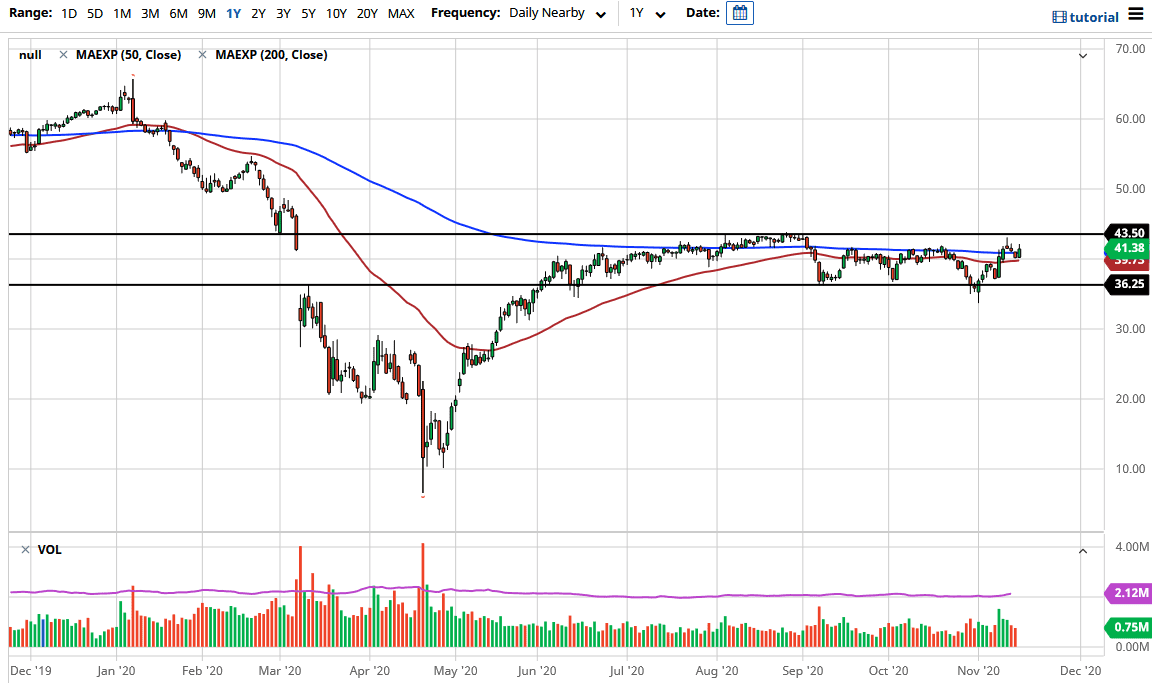

The 200-day EMA is currently slicing through the candlestick, just as the 50-day EMA is sitting just underneath. The market is likely to continue to go lower, so a break down below the 50-day EMA opens up the possibility of a move down to the bottom of the overall range. It could be as low as $36.25, but this is a market that has been supported in that area, so I do not know if we will break down below there in the short term. But the crude oil markets are oversupplied, so it is difficult to imagine that this market is going to struggle to gain anything significantly, because I do not care if there is a vaccine or not; there is no demand. We have been oversupplied for some time and that continues to be a major problem.

This market tends to be very erratic and will be all over the place. However, I do prefer shorting this market on signs of exhaustion, so I will be watching short-term charts. This is generally a day-to-day issue, which is why you need to be cautious. This market has gotten ahead of itself during the trading session on Monday, and it is therefore likely that the market needs to drift lower to bring things back to reality. If we broke above the $43.50 level, then it would be a major shift, but I highly doubt that will happen anytime soon. This market has struggled all along to break above there, and the systematic oversupply is going to continue to be a major issue.