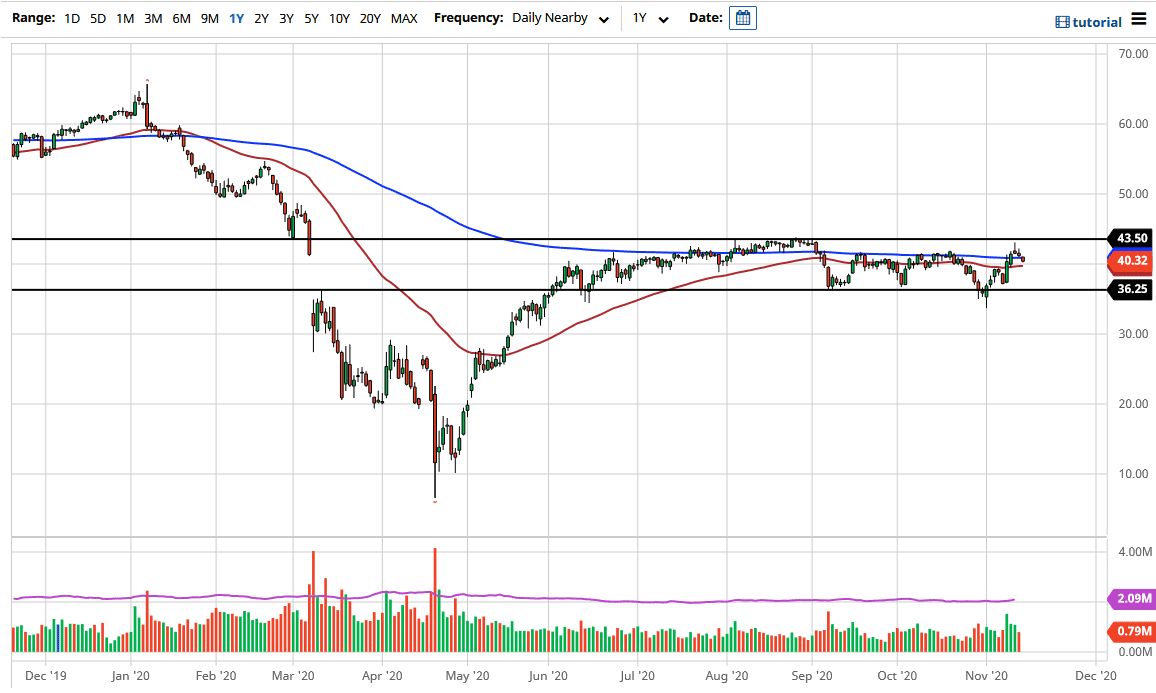

The West Texas Intermediate Crude Oil market fell slightly during the trading session on Friday, breaking well below the 200-day EMA. Because of this, the market looks as if it is ready to go lower, and the fact that we are reaching towards the $40 level suggests that we will test that big figure. If we break down below there, it would also be breaking through the 50-day EMA, which is also a technical barrier. The market may try to reach down towards the bottom of the overall consolidation that we have been in for some time now, perhaps reaching down towards the $36.25 level.

Looking at this chart, we have been sideways for some time, so it is not a huge surprise to see that we have given up the recent gains. The coronavirus figures are getting larger, so we will start to see the markets shift lower in expectation of demand. Furthermore, we also have the Thursday inventory figures that were less than idyllic. With too much in the way of supply and the coronavirus figures probably leading to a lockdown, it follows that this market continues to fall. Whether or not we break down below the bottom of the range is a completely different question, but we are at the very least going to go down to that area to test the region.

The market certainly sees the potential of a breakdown, and I definitely favor shorting this market as most are buying it, regardless of the recent surge higher. That surge was far overdone and even ridiculous if you give it some thought. Emotion does tend to take over the markets in time, and your job as a trader is to take advantage of markets when they get overexcited. We are going to continue to see this fluctuation until we figure out where we go for a longer term. But this is a scenario that is starting to look bleaker by the day.