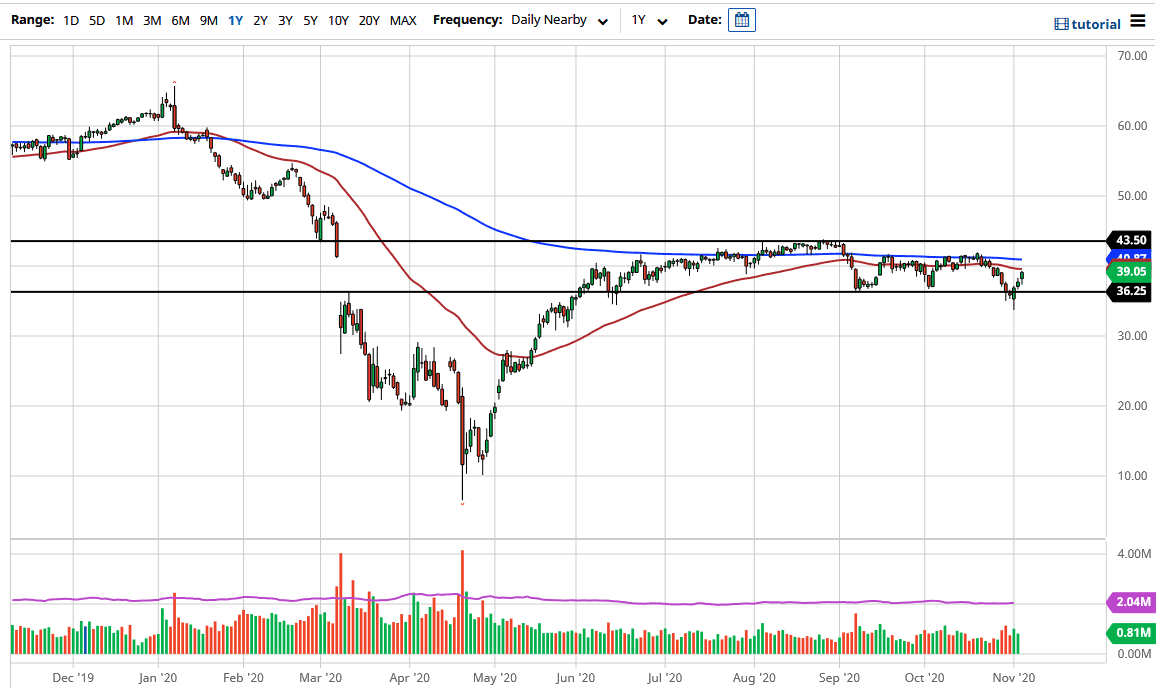

The West Texas Intermediate Crude Oil market has initially fallen during the trading session on Wednesday, only to turn around and rally again towards the 50-day EMA. The market is likely to see volatility, but the resistance above will start to come into the picture. The most obvious place would be the 50-day EMA which sits just above, but even if we do break above there, we have the 200-day EMA after that that may cause some issues.

I am waiting for some type of exhaustive candle in order to start selling again. The biggest problem is not necessarily that the price is expensive, it is just that any idea that the stimulus should increase demand is essentially fantasy. The last three stimulus packages have not shown themselves to do so. Yes, there is a small opportunity that we could see a little bit of a pop, but it will likely be an opportunity to short yet again. Looking at this chart, the market will go looking towards the lows again, especially if we see strength in the US dollar. The US dollar is what the market is priced in, so it will take less of those US dollars to buy a barrel of oil in that scenario.

I do not think that there is an opportunity to buy oil anytime soon, even though this has been a nice bounce. It still looks as if we are going sideways in general, and now we are in the middle of it. That is a situation in which people need to pay attention, and it is difficult to put a lot of money to work in one direction or the other, as we are in “no man’s land.” It is worth paying attention to the fact that we have made a lower low recently. If we break down below the candlestick from the Monday session, it is likely that we go looking towards the $30 level after that.