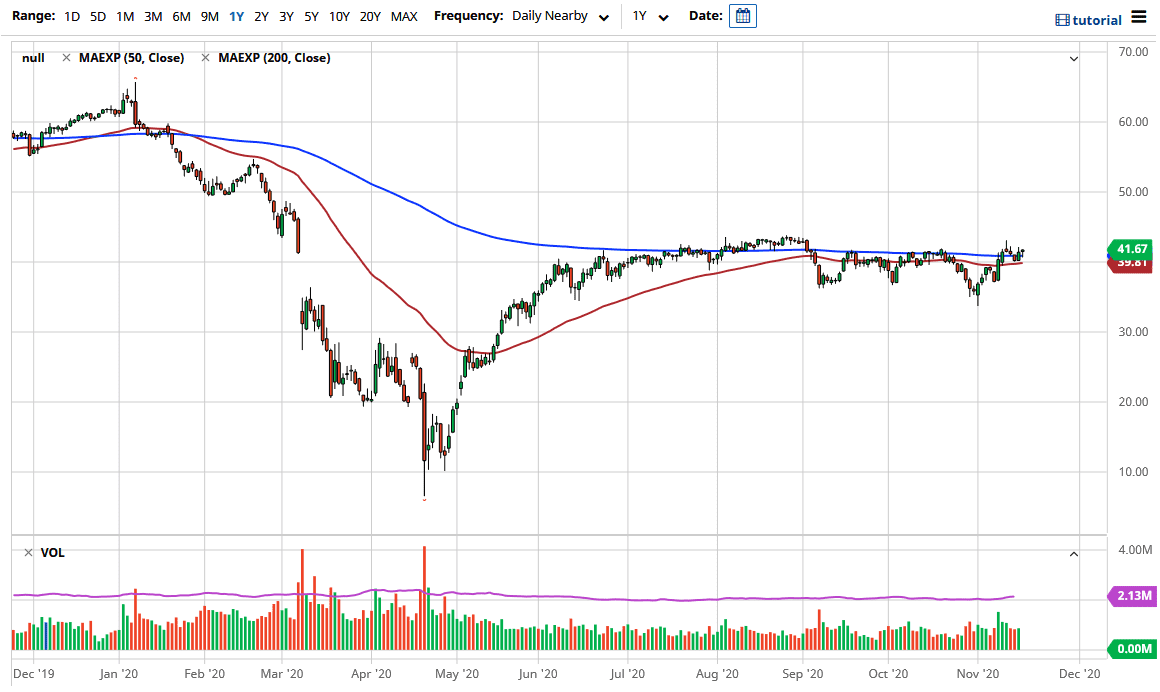

The West Texas Intermediate Crude Oil market pulled back a bit during the trading session on Tuesday, reaching down towards the 200-day EMA before bouncing significantly. We had a major bounce later in the day, as traders rolled over contracts. This market should continue to see a lot of noisy fluctuation, so we may have been given false security at the end of the session.

Looking at the chart, the $40 level is a large, round, psychologically significant figure that many traders will be watching closely. It is also an area in which we have seen a lot of vacillation, so we will continue to see a reaction to it. Whether or not we can break down below it might be a question for the next couple of days; if we do, it is likely that the market will then break down below there to reach down towards the $37.50 level which has been supportive in the past. The market will hear a lot of noise, but it is difficult to imagine that we are simply going to continue to take off to the upside as many economies around the world shut down. After all, demand will be very small, so we will eventually pull back and sell off again. We need to pull back towards the bottom of the overall range that we have been in.

If we did break out above the $43 level, then we could take off for a bigger move. But right now, that is asking a lot out of a market for which there is no demand. It seems like every couple of weeks there is a story in which people talk about how the demand will suddenly get a pickup due to one thing or another, but reality always hits right back with poor inventory numbers.