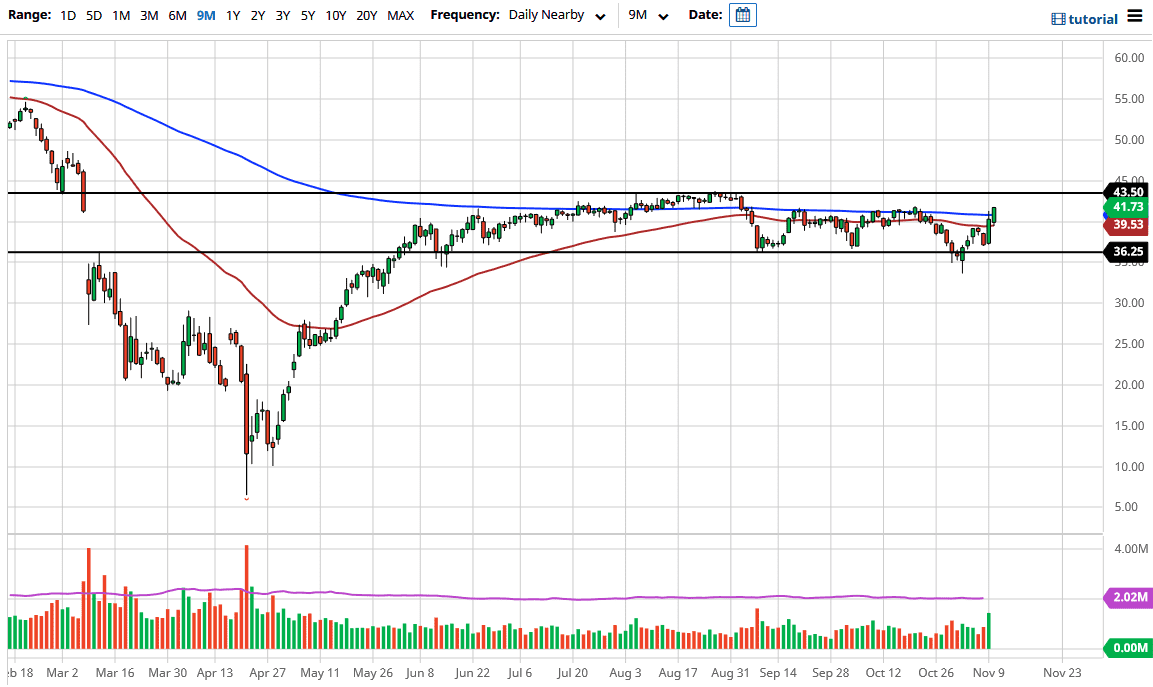

The West Texas Intermediate Crude Oil market has rallied significantly during the trading session on Tuesday, slicing through the 200-day EMA. The market is ready to challenge the massive resistance between here and the $43.50 level. That is a major area of resistance waiting to happen, and the first time we see signs of exhaustion it is likely that sellers will get involved.

Crude oil demand might have been a little higher than anticipated over the last week, but the market will continue to see weakness. It is likely to continue to see back-and-forth action overall, and as we get close to the top of the range, there will be massive resistance. This is a market that will be very noisy, but it is difficult to imagine a scenario in which demand suddenly picks up overnight. Crude oil traders have gotten ahead of themselves, and most people will start to think about that rather quickly.

An exhaustive daily candlestick is exactly what I am looking for, which we have not had over the last couple of days. However, just because there is a coronavirus vaccine coming in a few months does not mean that crude oil should be that much higher. Given enough time, I think reality sets back in; if not via demand destruction, perhaps a recovery in the US dollar. I do not see anything changing in this market in the short term, but if we break above the $43.50 level, I will have to re-evaluate the entire situation and assume that we would go higher.

The fundamental situation for crude oil is less than an ideal situation. The candlestick for the day is rather bullish, just as the one before it. Closing at the top of the range during the trading session on the candlestick means that we are going to see a continuation, but that does not mean that we are ready to go much higher for the longer term.