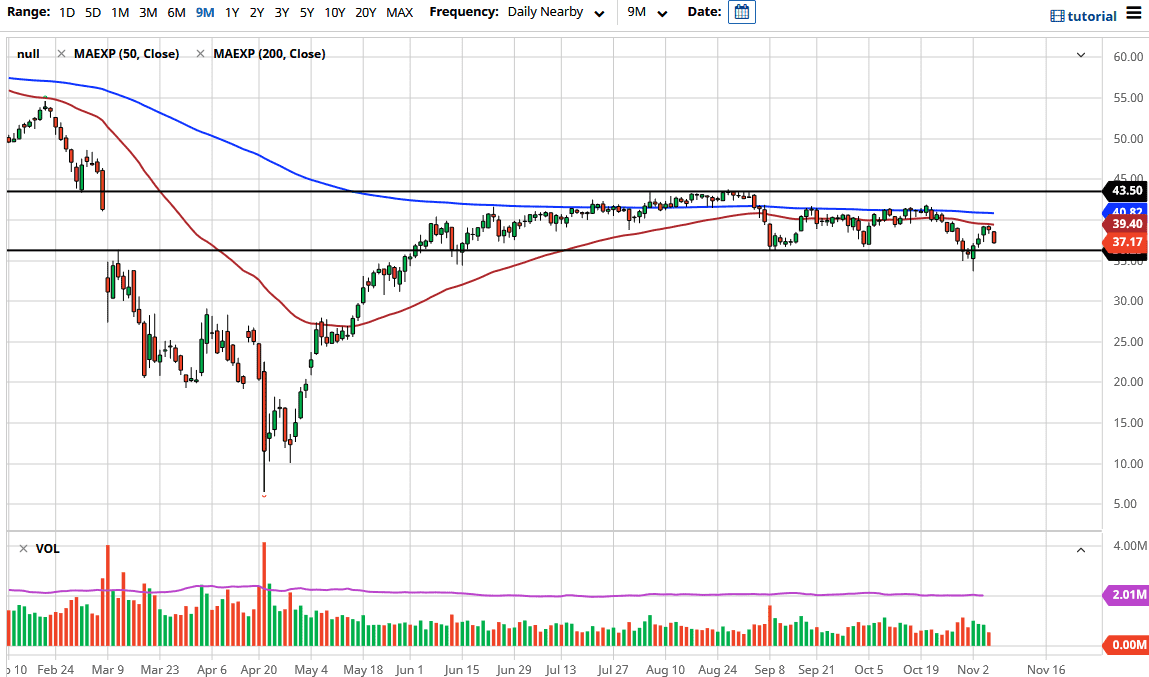

The crude oil markets fell slightly during the trading session on Friday as we have seen the 50-day EMA hold. Furthermore, we have broken down below the bottom of the candlestick from the previous session, which suggests that the candlestick is now officially a “hanging man.” That is a negative turn of events, which suggests that oil is ready to go even lower. Crude oil is likely to go looking towards the recent lows, just below the $35 handle.

Looking at this chart, you can see that we are starting to slump lower in general, so we continue to fade short-term rallies unless there is a sudden jump in demand. If stimulus is going to be smaller than initially thought, that will kill that narrative, or at least knock it back down slightly. If we are going to get less stimulus, people will become less excited about trying to buy assets such as crude oil. Looking at the candle and the way it is closing at the very bottom of the range of the day, it looks like we are going to reach to the downside.

On the other hand, if the market breaks down below the bottom of the candlestick from last week, which was the low, then it opens up the possibility of going down to the $30 level. We are sloping lower and it is important to pay attention to that. I have no scenario in which I'm willing to buy crude oil, as the 50-day EMA - which is colored in red - is resistance. However, we have the 200-day EMA above there colored in blue. That is an entire “range of resistance” of which people will take advantage. We have had several stimulus packages previously, and none of them drove up the demand for crude oil. The market is going to continue to see jagged and nasty trading action, but we have a particular direction that seems to be winning the day, so it is worth paying attention to that. If the US dollar starts to pick up steam again, that will beat the crude oil market quite drastically.