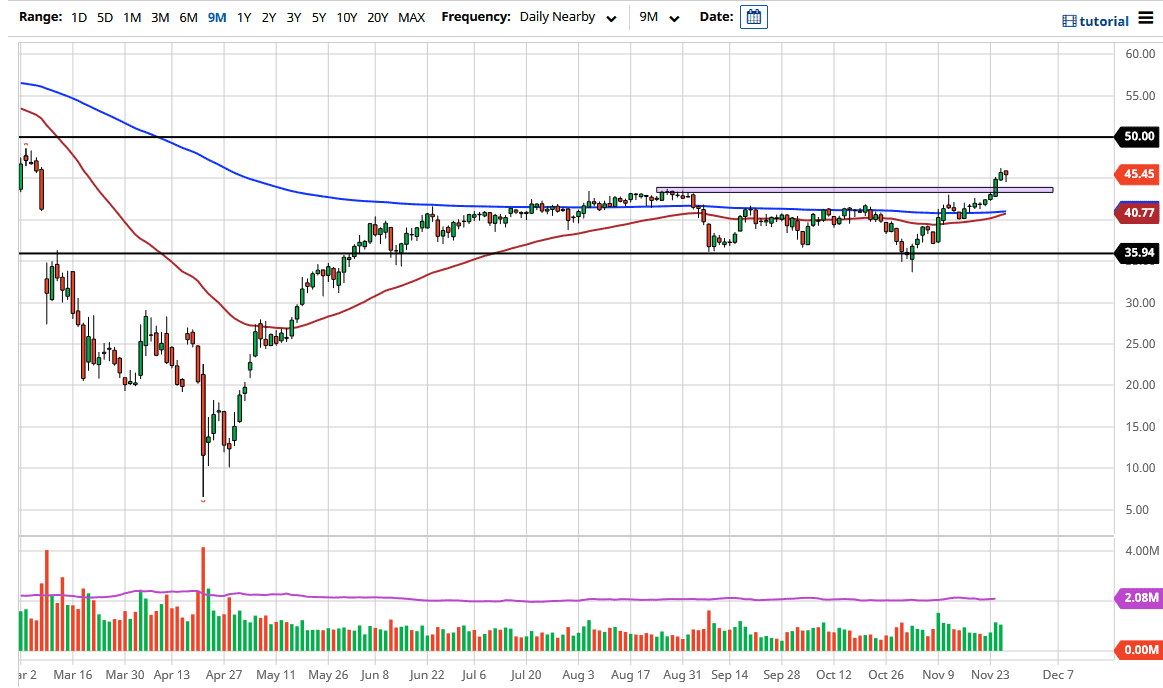

The West Texas Intermediate crude oil market pulled back a bit during the trading session on Friday, but found buyers underneath to support the market. But this will have been a fairly thin trading session, as the market has been relatively thin due to Thanksgiving and the following day. This is the problem with the markets, so what we are looking at here is a continuation of the overall breakout.

Looking at the 50-day EMA underneath (colored in red), oil is trying to break above the 200-day EMA. This suggests that the market is starting to go into an uptrend, but the moving averages are a bit late on this. The fact that we broke above the $43 level was the first “hint” that we are ready to continue climbing. It is clear that pullbacks will continue to attract attention, and the fact that we are starting to see rumors about OPEC extending its production cuts may also help.

The other thing to pay attention to is the fact that many traders out there are trying to bank on a “post-vaccine world.” That suggests that there would be more demand for crude oil. However, we had problems with oversupply in the crude oil market, which should continue to be the case longer term. In the short term though, we will continue to bounce, and there is a serious desire to try to drive crude oil towards the $50 level above. That is an area in which I will be looking for signs of exhaustion but, in the short term, it looks like buyers will pick up each dip.

If we did break down below the $43 level, then we could go looking towards the 50-day EMA underneath. But right now, I think we are probably more likely to find buyers based on hope. Looking at the shape of the Friday candlestick, it is obvious that there are people out there willing to pick up the market, so there is no point in trying to fight it. If the US dollar continues to weaken, that could also provide a short-term boost.